Avoid headaches and find business opportunities with transactional marketplaces

Marketplaces can be difficult to establish, as they need to attract both sellers and buyers to succeed. But we have seen that after the market has adopted a marketplace, it can be very successful.

Marketplaces can be difficult to establish, as they need to attract both sellers and buyers to succeed. But we have seen that after the market has adopted a marketplace, it can be very successful.

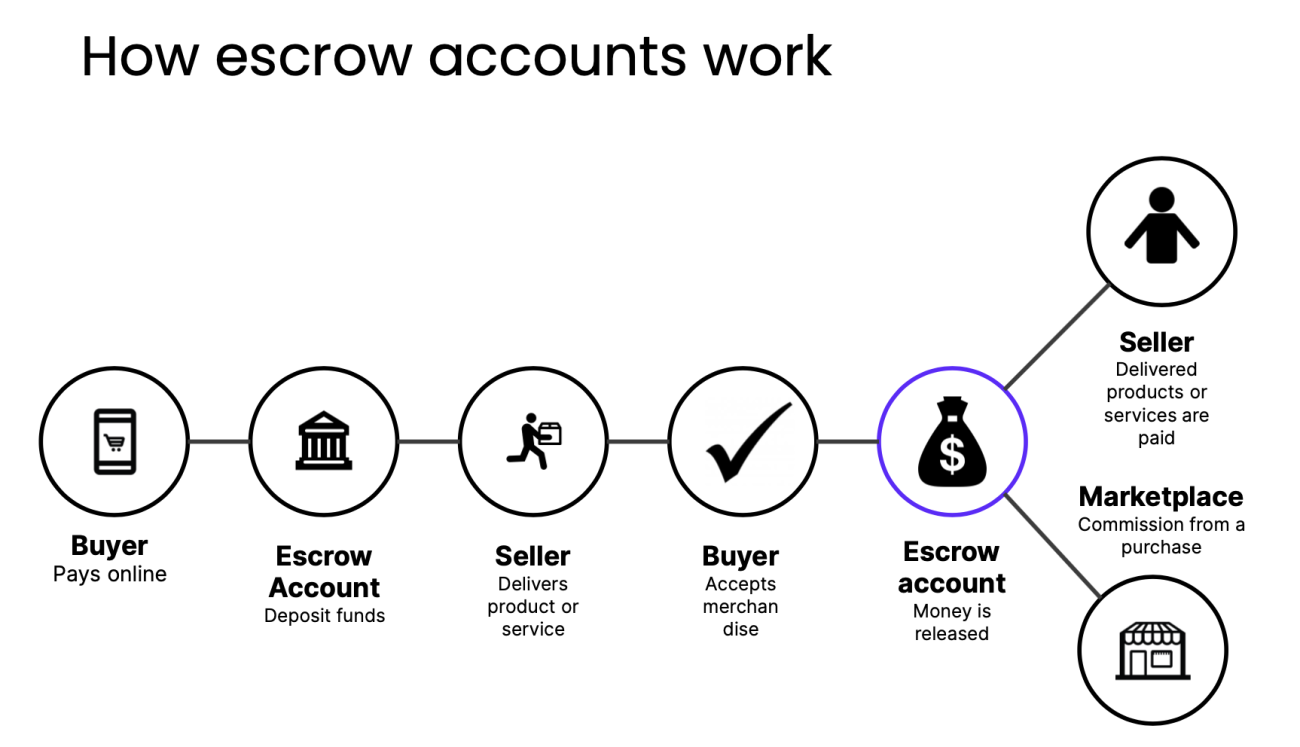

Most successful marketplaces like Ebay, Aliexpress and Wolt are transactional. In a transactional marketplace, the buyer pays money to the marketplace and the marketplace remits it to the seller. Passing the funds to the seller can be delayed or fast-forwarded, depending on the nature of the transaction.

Transactional models pose unique challenges with payments and onboarding. When the marketplace is holding customer funds, it becomes a payment institution. Payment institutions are regulated and supervised to ensure the security, ease and efficiency of payments. Among other requirements, payment institutions are required to:

- know their customers;

- monitor and assess transaction and customer risks related to money laundering;

- assess, report and minimise operational and financial risks; and

- establish organisational roles and responsibilities for payments.

Applying for a payment institution licence is not rocket science, but it can take some time. If you are just opening the marketplace and volumes are low, you may want to start with a lighter registration process and get the full payment institution licence later. It is also possible to completely outsource the payment institution part, which is especially useful if you have a small organisation or want a fast go-to-market process.

An account used to hold customer funds is called an escrow account. Facilitating transactions in the marketplace and transferring customer funds through an escrow account, makes the marketplace a payment institution.

The transactional model has specific benefits for the marketplace, but also for both buyers and sellers:

Trust and customer experience

- Payments can be received and remitted before or after the item has been delivered

- Smooth onboarding and identity verification for all customer segments

Additional revenue streams

- A transactional marketplace gives the possibility to earn commissions

- Easy integration with third-party services for logistics and other value-added services, like insurance or financing

- Modern and flexible payment options increase conversion

- Possibility to onboard new customer segments

Increased customer loyalty

- The loyalty program can include rewards for both sellers and customers

- Alternatively, the loyalty program can let sellers reward their customers

For sellers and buyers

- Lower payment costs

- Improved conversion and greater buyer reach

- The possibility to require receipt of the merchandise before the seller is paid increases trust

- Fully integrated checkout experience with a wide variety of payment options

Onboarding headaches faced by marketplaces

Onboarding customers has previously been an at least partly manual process that takes time and is prone to errors. Our recent experience shows that the processing of most onboarding requests can be automated.

- B2B online payments: Making purchases as a business is unnecessarily complicated. The checking of purchasing rights, identity verification and invoicing can be automated for most transactions. Basic checks are low-cost, so the process can be designed to perform free-of-charge and low-cost checks first.

- Business or consumer seller: Automating onboarding for low-risk sellers can cover up to 80% of all onboarding requests, depending on the business. Fraud is an increasing problem in eCommerce, and gaining the buyers’ trust makes them return and buy again – knowing your buyers and sellers ensures transparency and helps to prevent fraud.

- Consumer online payments: Google has announced that it will be phasing out support for third-party cookies in Chrome. If you onboard all of your customers to the platform, you can keep interacting with them in the future. You may also be required to collect customer data for payment and refund purposes. Account information services might be useful if you are financing your customers’ purchases.

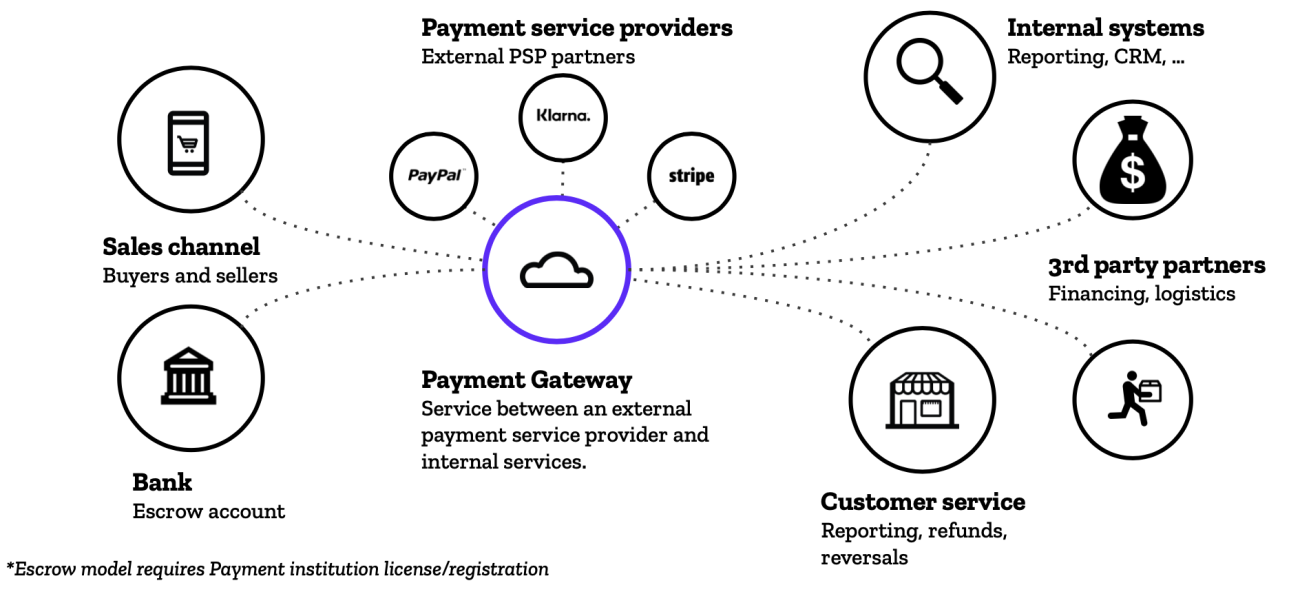

The Payment Gateway concept adapts to business needs and enables capabilities for transactional marketplaces

The Payment Gateway, or payment intermediation system, is a custom payment solution that integrates different systems and harmonises the payment experience from the systemic and financial perspectives. The Payment Gateway system is not an out-of-the-box product, but is developed according to business needs.

The Payment Gateway enables the addition of new payment channels, payment methods and business users to a single centralized system with ready-made integrations to financial reporting tools and other systems.

A separate admin interface is often implemented as part of Payment Gateway development, so that customer service can see the transactions passing through the system and detect possible errors. The admin interface can also include tools for handling suspicious transactions and onboarding cases.

Qvik has implemented and designed a number of Payment Gateway projects over the years, so we have a tried and true recipe for the payment needs of marketplaces and multi-channel businesses. A custom solution brings a significant competitive advantage for companies building their business around innovative ideas and custom solutions growing faster than the rest of the market.

Technical implementation

Your business requirements are the foundation for choosing the right technologies. As an independent expert, Qvik can help you to find the right technology for implementing marketplace platforms and the Payment Gateway. Serverless or containerized, we know the pros and cons and will help you design and develop the leading marketplace.

Illustration: Niina Nissinen