Compensating your carbon footprint should be easy

Compensate is a nonprofit organisation that’s combating climate change by offering emission calculation and offsetting tools for individuals and businesses.

Compensate is currently in the early stages of growth, looking for ways to scale their business. The organisation has a two-fold mission: to enable a truly sustainable, carbon-negative future by acting with merchants as well as end consumers.

So far, the organisation has enabled the planting of over 1.5 million trees, the preservation of 1,300 football fields of forest, totaling an impact which equals the compensation of almost 200,000 barrels of oil.

“Climate change is a system level challenge, and Compensate is building a systemic solution for it. We believe that payment providers and companies will play a huge part in the necessary system change and offer highly scalable solutions for both individuals and businesses the world needs.”

Annikki Laine, Chief Product Officer at Compensate

Compensate needed more background on payment processes and how its service could be added directly to the payment flow in order to reach out to a broader customer base. Qvik had the right competence, was eager to help and felt that Compensate’s mission is really important to society.

“For a company like Compensate to succeed, it is crucial to make compensating part of everyday consumer transactions. Qvik’s expertise helped us map our options in the complex payment ecosystem,” Laine Says.

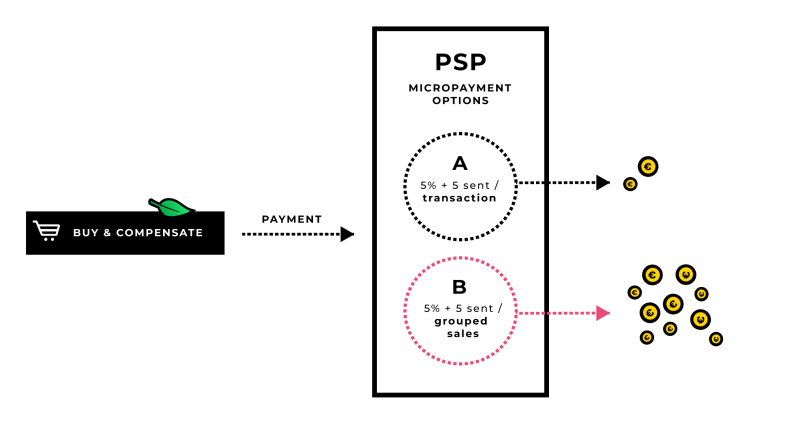

Climate compensation transactions could be called micropayments. Micropayments are low-value transactions, typically with high volumes. The cost of these transactions requires special attention, compared to higher-value transactions where the fixed cost is not such a big deal. Micropayments are sometimes aggregated to reduce the number and thus the cost of transactions.

Data plays an important role in carbon footprint compensation. During the project, we thought about what data flows through the payment value chain and could be used to calculate carbon footprints. Open banking might offer new possibilities by enabling access to account data in the future, but unfortunately that world is not here yet.

The other side of the coin is the actual transaction, how to make it as smooth as possible for consumers without encumbering the checkout flow with extra steps. This requires data analysis too.

The payment industry is highly regulated and standardized, which makes it a bit complicated. Many companies have grown by buying others. This means that non-scaling legacy platforms are common. So if we would implement something in Italy, let’s say, it would not necessarily be scalable to other countries.

Estimating versatility, coverage and data capabilities

Qvik had preliminary discussions with relevant players on the market and delivered strategic recommendations to Compensate. During the discussions, we estimated factors like versatility, coverage and data capabilities. These factors were then compared to assess which partnerships would enable Compensate to scale via platform integrations.

Qvik has a deep understanding of the payment industry and an extensive network of contacts. Despite fruitful cooperation and relationships within the industry, we are nevertheless neutral and independent. That means we can serve as a neutral advisor and find the best solutions on the market.

For more information

Säästöpankki

The Säästöpankki mobile app is more than just a channel for using banking services – it’s also an everyday personal assistant.

Posti Payment Gateway

Qvik has designed and developed the Posti’s cloud-native, multichannel Payment Gateway solution together with Posti.

Suunto – Improving the Suunto 7 purchase flow

Qvik evaluated the Suunto 7 watch’s whole purchase experience from the first social media ad to unboxing and strapping the watch onto the wrist for the first time.