Why is Finnish e-commerce lagging behind the rest of Europe?

According to PostNord's European e-commerce survey published in November, Finland is still at the bottom of the pack in online commerce.

According to PostNord’s European e-commerce survey published in November, Finland is still at the bottom of the pack in online commerce. The pandemic has increased online shopping in Finland by 30 percent, but this growth has been even higher in most countries.

PostNord’s survey says that the pandemic spurred e-commerce growth in practically every European country, with some markets seeing as much as 40 percent growth from the previous year.

This article was previously released in Finnish on Fintech Farm Helsinki’s blog.

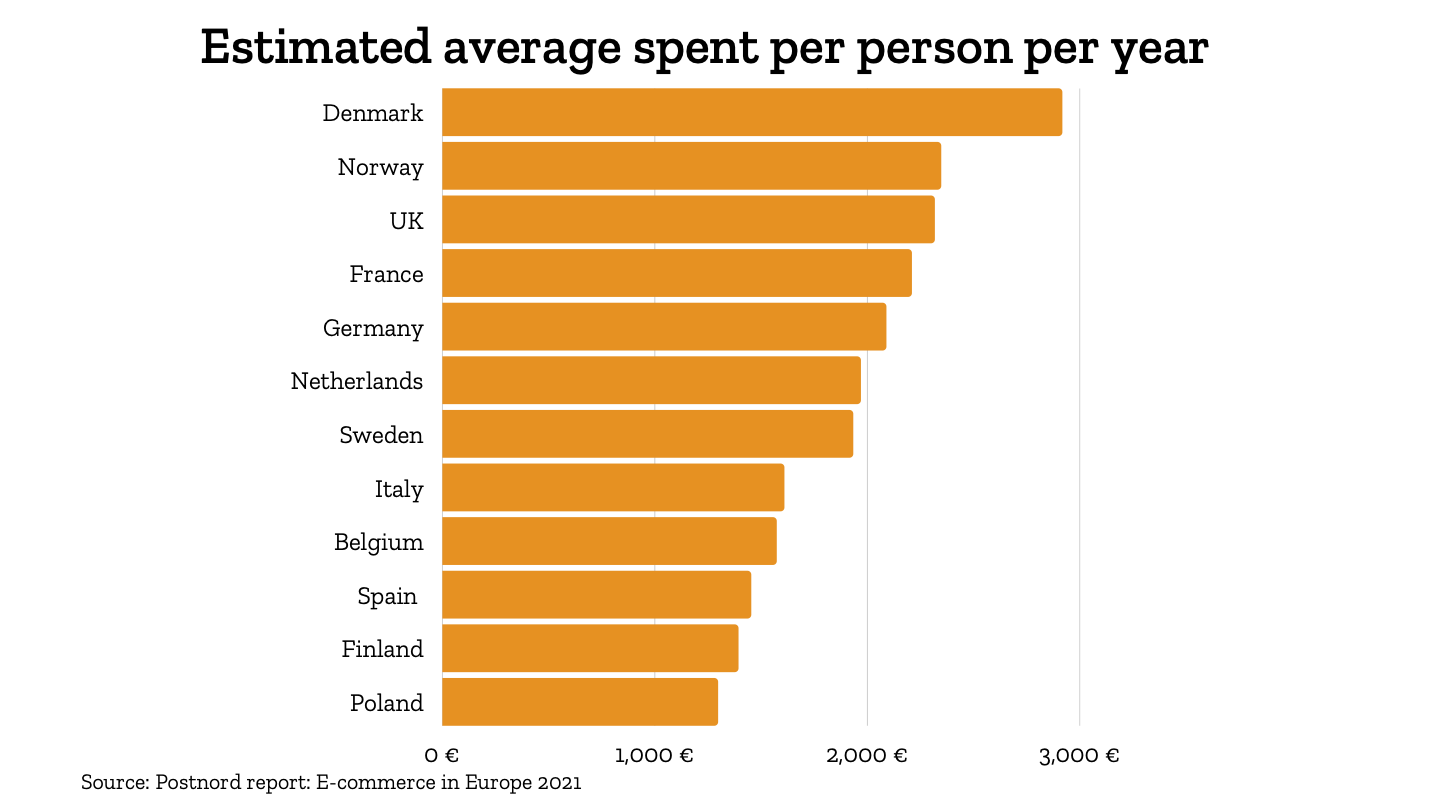

The European leaders in online shopping are Germany and the UK, where average purchases are high and e-commerce has a significant share of the retail market. Denmark, Norway and France also make the top of the list when looking at annual purchase volumes alone.

According to PostNord’s e-commerce survey, the three most popular product categories in Europe are shoes and clothing, home electronics, and books and audiobooks. This is also the ranking in the Nordics.

The survey asked consumers whether they were intending to increase or cut back on their online shopping after the pandemic. Responses varied by market area. In Germany, for example, consumers shop a lot online, but also want to patronize brick-and-mortar stores.

Finland at the bottom of the list in nearly every indicator

Of the twelve countries considered in PostNord’s survey, Finland ranked second to last in annual shopping volume per capita. The only country behind us is Poland, where the purchasing power is much lower.

Six out of ten Finns say that they shop online at least once a month. There is a particularly big gap to the other Nordic countries in the older generations’ attitude to online shopping. Aged Finns are more skeptical of e-commerce than other Nordic senior citizens.

In all the statistics published in the survey, you will be hard-pressed to find a graph with Finland at the top. Well, there is one, but it’s not flattering. Finnish people make the most purchases from foreign stores, with up to 80 percent doing so. Their favorite is Zalando.

Smooth payment is essential

The Finns are used to paying for their online shopping with online bank transfers. More flexible payment methods are slowly gaining ground, however, and it is now possible to separate the payment from the purchase, with the customer paying when it best suits them.

In Sweden, for example, invoices and Swish mobile wallet payments are the most popular online payment methods next to card payments.

The Single European Payments Area SEPA recently published the SRTP (Sepa Request To Pay) service specifications. The SRTP is not actually a new payment method, but rather a set of rules, messages and technical solutions with which the recipient can request the payer to initiate payment.

This service is pegged to become a serious competitor to traditional e-invoices. Real-time mobile payments are a great way to improve the customer experience in smaller online purchases. You can read more about the most popular mobile payment methods from our article Mobile payments in Finland – These services are available right now.

The power of last-mile logistics

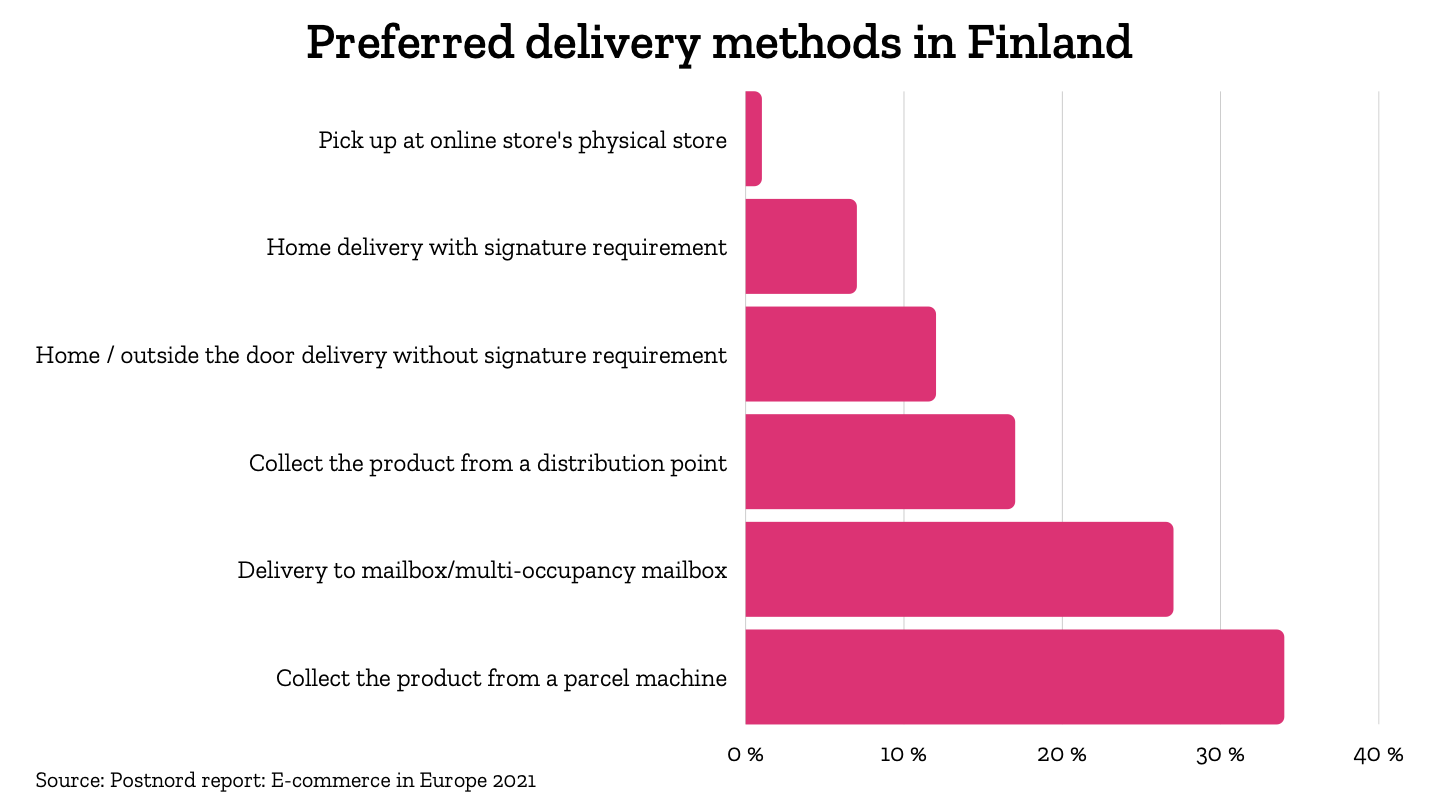

The last-mile logistics in Finland can also be a factor in the popularity of online shopping. Last-mile logistics refers to the final delivery stage to the customer’s front door, which is often the most expensive part of shipping. Distances in Finland are longer than in most other European countries, which naturally increases shipping costs.

Finland was the only country in the survey where home delivery was not among the top three shipping options. Somewhat surprisingly, 34 percent of Finns say that they prefer to pick up their deliveries from a parcel point.

Like the Poles, only a minority (16 percent) of Finns are willing to pay extra for environmentally friendly shipping. There are no differences between Finland and the rest of Europe in delivery time preferences, however.

Online store technology affects the purchase experience and scalability

Traditional e-commerce systems (like Shopify) package the user interface and back-end into the same product. This means that if a vendor uses the back-end system for product management, sales and distribution, they also have to use that platform’s UI.

Such systems are prone to grow into monoliths incapable of scaling or adjusting to new requirements. Many Finnish online stores have opted for such traditional commerce platforms, but the pandemic has shown that the ability to scale and adjust business operations at short notice is vital.

Headless Commerce platforms do not include a UI, which can be implemented independently, with the UI and platform communicating over an API.

But Headless Commerce platforms are only part of the solution to the monolith issue and can be complemented with modular solutions.

In a modular solution, every functionality is an individual microservice, meaning that a modular platform is scalable to the needs of, for example IoT-solutions. Laundromats can request more detergent, or refrigerators order a milk delivery, by communicating with the modular platform. Modular e-commerce platforms are thus scalable to practically any conceivable business need.

Conclusions

A big slice of the Finnish online commerce market is still there for the taking, and vendors have a golden opportunity to expand their clientele in Finland.

The keys to e-commerce success are product selection, customer experience, convenient payment, logistics and sustainability. Do these things right and pick a scalable, flexible technology, and you are setting yourself up for success.

Illustration: Niina Nissinen