More companies want to issue their own credit cards. How to stand out from the competition?

There are almost 40 traditional credit cards on the Finnish market, with more on the way. These cards compete for customers with methods both ancient and novel. New players looking for a slice of the pie need to know the playing field and how to stand out. Credit cards are one of the few sources […]

There are almost 40 traditional credit cards on the Finnish market, with more on the way. These cards compete for customers with methods both ancient and novel. New players looking for a slice of the pie need to know the playing field and how to stand out.

Credit cards are one of the few sources of income possessed by banks, but the traditional credit card business could be heading for rough seas. The threats include new, fully digital banks like N26 and Revolut, along with the tightening of EU regulations and the Finnish Credit Act. Attractive competitors, such as Apple Card, are also on their way.

Moreover, launching your own credit card and payment facility seems to be a corporate trend at the moment. A few years back, St1 Nordic was one of these companies looking for angles, benefits and competitive advantages. St1 Nordic established its own finance company, St1 Finance, and launched its own, Apple Pay compatible credit card.

How do current cards work, and how can new players compete?

Standing out in the credit card business is no simple feat. Users are starting to take choosing your own PIN, convenient authentication, mobile apps and low interest rates for granted, and soon such features will fail to draw attention.

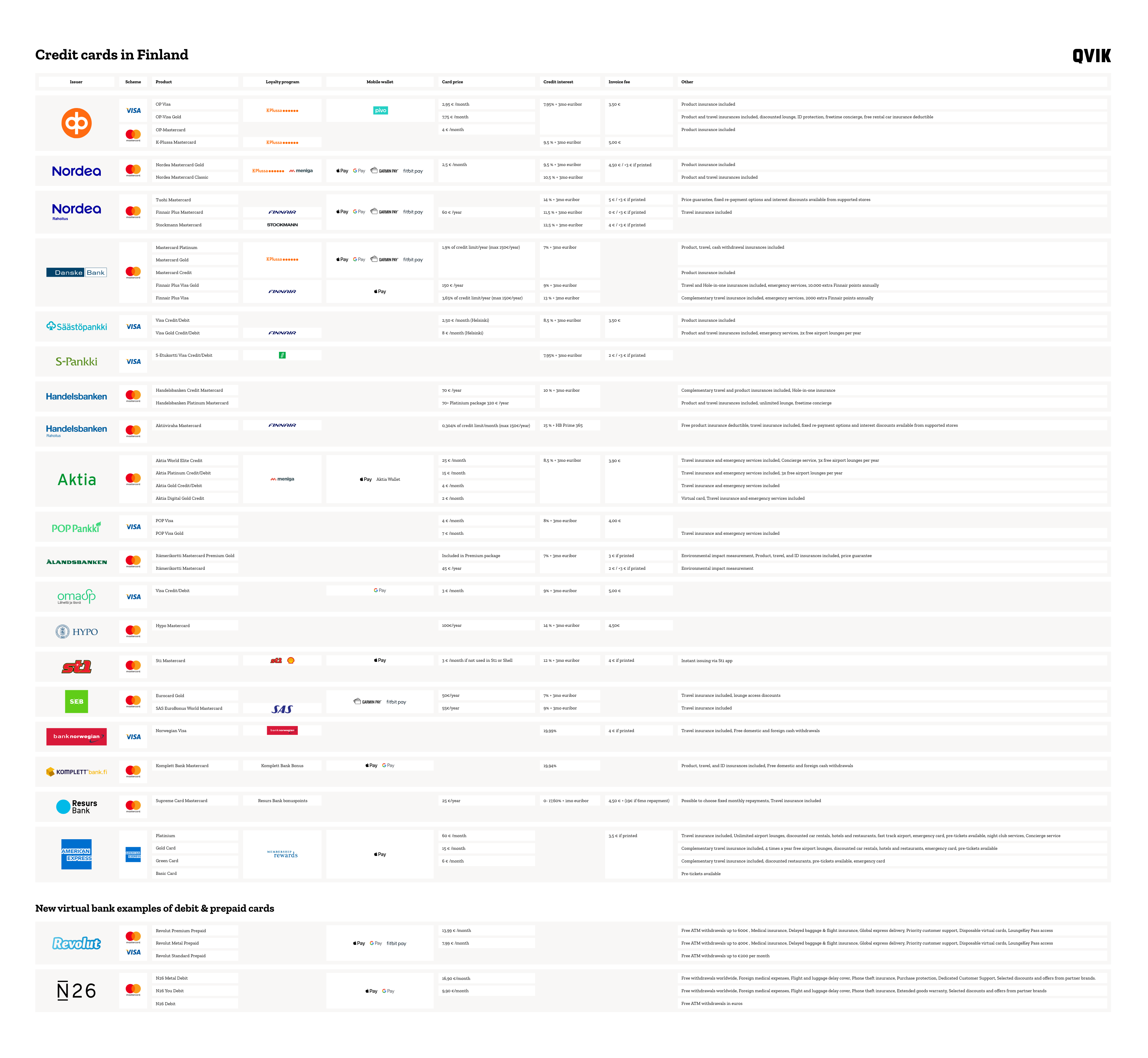

We compared the competitive advantages of credit cards available in Finland: costs, loyalty benefits and electronic features. Our comparison included only the most common credit cards and excluded those issued for limited audiences, such as private banking and student cards.

The market is currently very diverse, offering everything from fully mobile solutions without physical cards to banks with no modern mobile payment solutions at all. The latter need to act soon if they want to keep up with the competition.

You can view the table here. The following image is here just to show you that there’s already a wide variety of cards to choose from, and the competition is complicated.

There are more than three million credit cards in Finnish wallets right now. The number of credit cards and amount of credit issued is growing steadily.

Credit card market shares are not public information and banks, card companies or other players do not report on them. The cards of big banks like OP, Nordea and S-Pankki are presumably the most common, but a high number of issued cards does not guarantee profitable business for the bank in itself.

Building business around your credit card

Calculating the business logic of credit cards is more difficult than ever. EU regulations have pushed the fees paid by merchants to card issuers so low that they cannot sustain profitable business. Credit legislation and competition has also made it very challenging for issuers to market their profitable, interest-bearing credit to consumers.

Many issuers are still basing their revenue on fixed annual or monthly fees, as they guarantee a certain amount of income for the bank even if the card is not used actively.

Others, such as Norwegian and Komplett Bank, build their business on maximizing card use through bonus schemes, free cash withdrawals and travel insurance policies. These banks calculate that their customers will eventually need to use the most expensive credit on the market.

The cashback systems of loyalty schemes vary widely. Groups like S-Bonus and Kesko offer hard cash in return for purchases, while Norwegian, Finnair and Amex pay out their benefits as points calculated with complex formulas.

Data is still not widely used as a source of revenue in Finland. New challengers, like the prepaid-based N26 and Revolut, will probably squeeze every last drop of value and information from their cardholders, pushing the traditional banks into an even tighter corner.

Proprietary card or partnership with a bank?

Companies looking to issue their own cards basically have three options:

1) The merchant can link a loyalty scheme to a bank-operated card. Normally the bank then receives the income and bears the risk.

2) Sharing the risks, costs and revenue with the bank, for example with a 50/50 split. The credit card with the bonus scheme is jointly owned and managed by two companies or a joint venture.

3) Filing for a license and doing it all yourself. The merchant will then bear all the risk and costs, but also enjoy all of the revenue.

All of the above arrangements need a card system operated by a company like Enfuce or Nets for processing the card transactions, interest rates, billing, payments, etc.

Issuing your own card requires expertise, systems and licenses, along with a willingness to take risks. Many companies are nevertheless tempted by the prospect, since a successful card issue can generate a broad, credit-using clientele that fills the coffers with revenue from interest and fees.

The risks and costs are significant, however, and failure could even bankrupt the company.

For companies that just want a loyalty scheme, the safest option is to focus on operating a high-quality loyalty system and leave the credit card business to the bank.

We will soon release results of our survey on credit card use and bank loyalty in Finland. Subscribe to the newsletter to stay in the loop!