Apple Pay will shake up the Finnish mobile payments market – this is what will happen

The Finnish mobile payments market is currently buzzing, and at least one major shake-up is still coming in 2017: Apple Pay. The iPhone-based payment system will provide some tough competition for the MobilePay, Nordea Pay, Siirto and Pivo applications of Nordic banks.

A smooth mobile payment is still a rare phenomenon in Finland, but we are headed there. In a few months, Apple Pay will make contactless payment and wallet functions available to iPhone users and, apparently, the service will be well received in Finland too.

“Even though other mobile-focused payment service companies may have different opinions, Apple Pay will make mobile payments technically easier, and not just in contactless payments”, says Qvik’s Head of Design, Matias Pietilä. “Soon, you will be able to use Apple and Android Pay payment solutions for in-app purchases, without the need for go-betweens.”

Half a dozen payment service companies are preparing for the arrival of Apple Pay in Finland, and it is probably no coincidence that these companies are now selling for big money. For example, Sampo just participated in a EUR 4.5 billion bid for Nets and OP Group member Checkout Finland acquired Solinor’s Payment Highway business.

“Over the years, we have worked with nearly every mobile payment method on the market, and we also want to offer our expertise to customers with Apple Pay as soon as it lands“, Pietilä says.

Looking at their population, the Nordic Countries are not exactly attractive territory. Before Finland, Sweden and Denmark, Apple Pay has only been launched in roughly a dozen countries, all but Ireland and Switzerland with populations ranging from the dozens to the hundreds of millions.

The Nordics possess a different type of attraction, however.

Technical payment infrastructures, such as contactless payment, are extremely robust here. Services such as electronic financial services, customer authentication and e-invoicing work well, and customers are familiar with electronic identities. Digital services are widely used in the Nordic Countries, but we still have work to do on the payment and purchasing experience – both in terms of quality and quantity. Mobile has nevertheless made a real breakthrough here, and consumption is migrating to the digital channel.

You’ll soon call your wallet a phone

We have been talking about mobile payment for more than 15 years, but now things are finally starting to happen. According to a survey by Paytrail, no less than 40 percent of Finnish people make purchases on their mobile phones or tablets, and 65 percent of these purchases are made in apps. People already think of their phones as payment instruments in online and app stores, so the leap to using other wallet services when contactless payment becomes easier should not be too big, at least in theory.

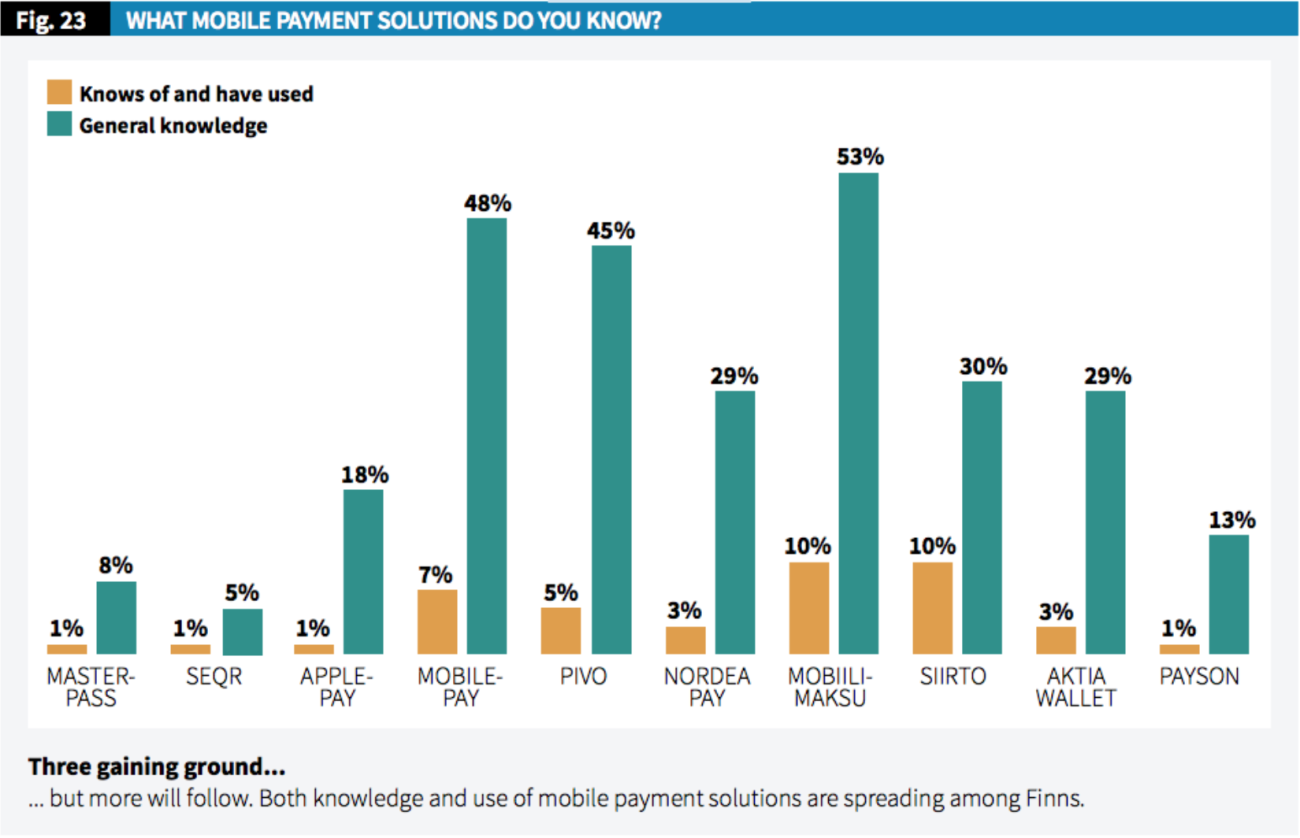

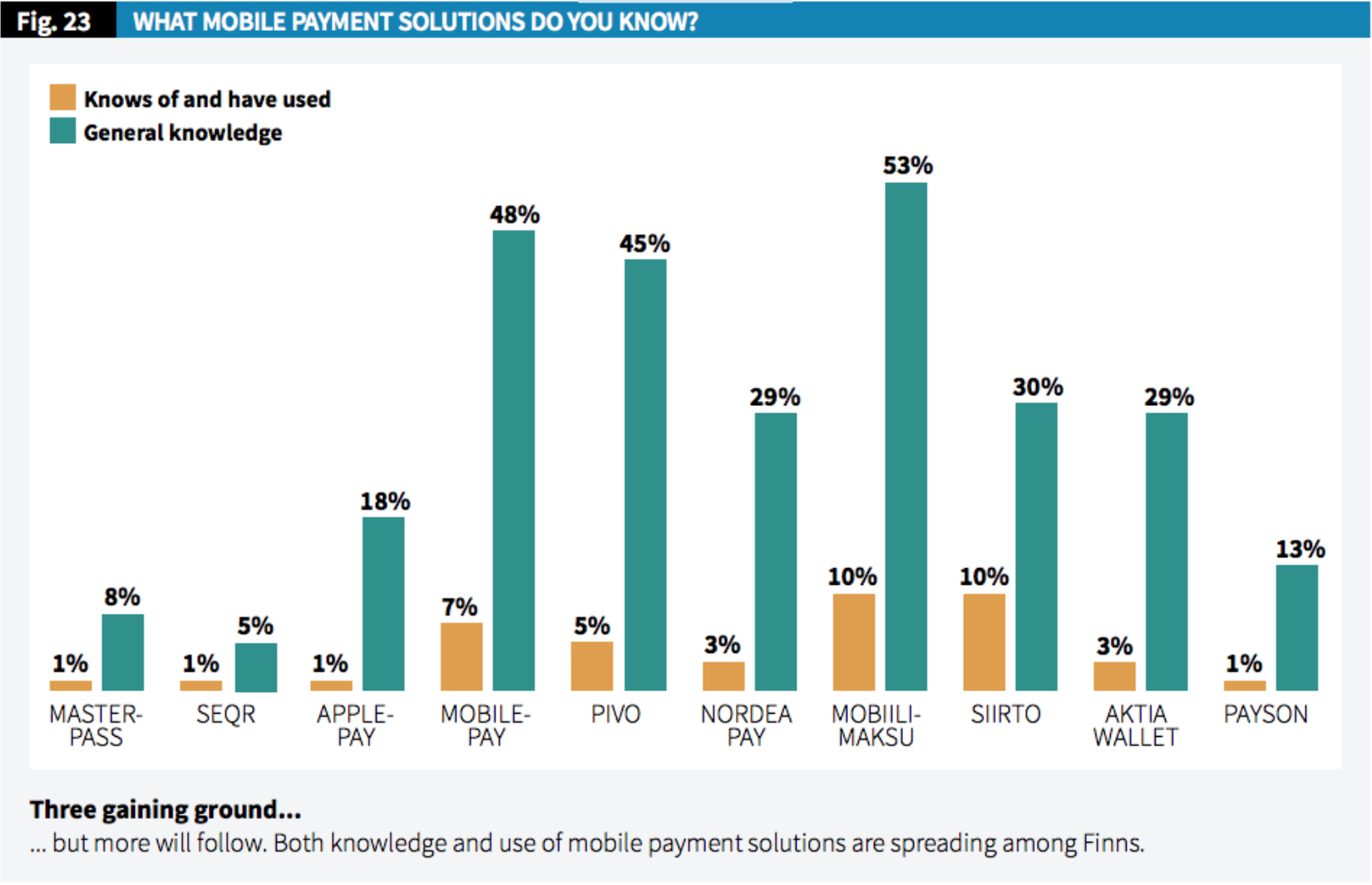

The best-known mobile payment services in Finland are MobilePay, Pivo and Mobiilimaksu, but their user figures show that there is still room for new services. According to the survey, Apple Pay was still unfamiliar to the Finns – less than one in five people knew about it.

Finnish familiarity with and use of mobile payment services. Screenshot of Paytrail’s survey.

Nevertheless, the expectations for Apple Pay’s success are high. In light of these statistics, it will be intriguing to see how the service will fit in with the other payment service providers, and whether more Finns will adopt the mobile wallet as a result.

The future developments of the mobile payment market do not rest on the shoulders of Apple Pay alone. The new payment service directive, PSD2, will mix things up further in 2018. The directive will obligate banks to open their customers’ accounts directly to third parties with the customer’s consent. Until now, access to accounts has been limited to banks, but third-party services will soon be able to examine and charge the accounts of customers without intermediaries. The Finnish mobile payments sector will have to prepare for another blow immediately after Apple Pay.