Date

24 June 2024

Category

Digital business, MobileTechnology choices and downloads of top Finnish consumer apps in 2024

Finland is renowned for cutting-edge technology, and our app market is full of innovative solutions. As a digital agency wanting to build successful mobile services, we need to understand it inside out. Therefore, we recently examined the technologies and downloads of the top Finnish consumer apps. Discover our findings in this blog.

Do you know your competition in the app market? While we are sure you know your industry’s best practices like the back of your hand, the mobile race doesn’t end there. Ultimately, your service competes with all the other apps out there – for the consumers’ time, money, and attention.

Most Finns only pay for up to three mobile services (Qvik Insights study, 2023). For your app to be one of the few driving sales, technical performance and user experience (UX) must be top-notch.

Both performance and UX are highly affected by your chosen technology. This study explored the technology choices and downloads of top Finnish consumer apps to understand benchmarks across industries. We examined 93 apps, and excluded games.

Qvik’s software engineers collected the data in June 2024 by using custom scripts to extract tech stack information from Android Application Package (APK) files.

Although the findings directly reflect Android, we assumed that companies use the same technology stack for Android and iOS apps.

Categories of apps analyzed

Five years ago, we already crowned Finland Europe’s leading app development country, and today, the Finnish app market is mature and versatile. Finns know that apps provide the strongest digital link between brands and customers, and extensively use them for business in various sectors.

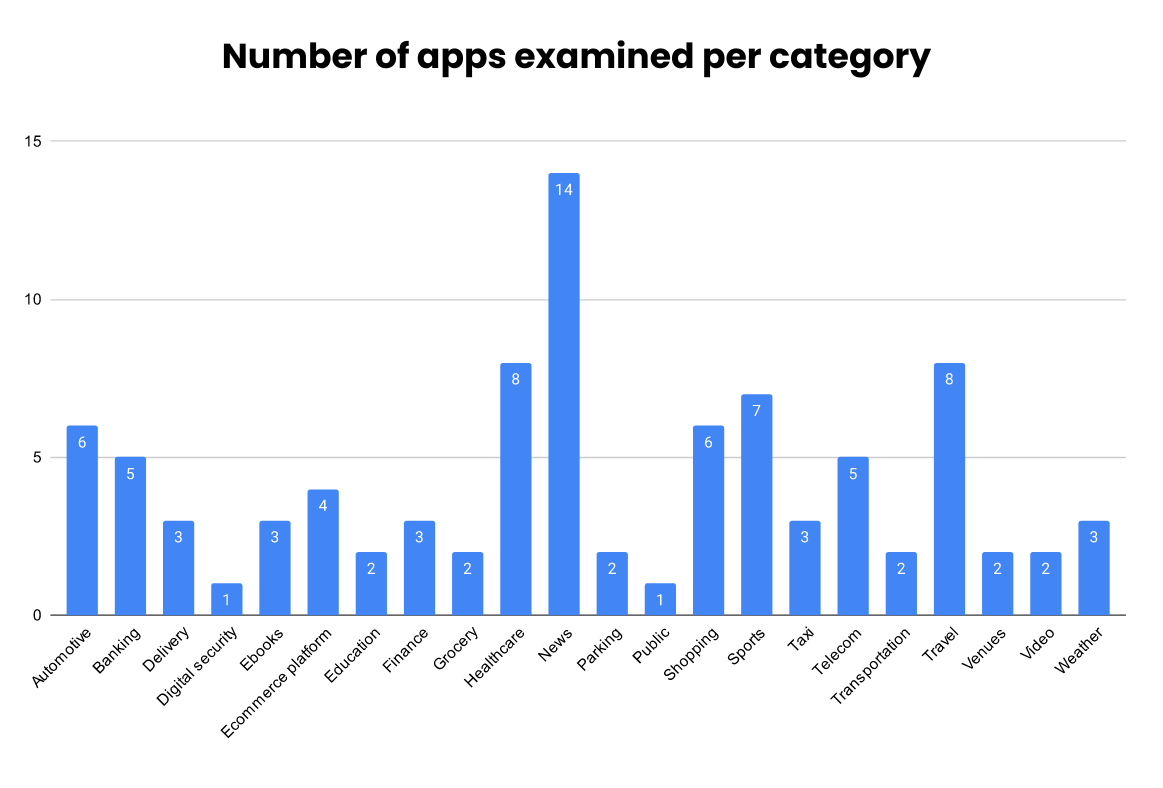

As top services scatter throughout categories, the apps in this study span various industries. The most significant sectors represented are news, travel, automotive, sports, healthcare, shopping, and banking. The specific number of apps examined per category is in Graph 1.

Downloads of top Finnish consumer apps

One of the most common metrics for app success is the number of downloads. Overall, the install numbers of Finnish apps indicate the vast adoption of mobile across various categories, particularly in essential services.

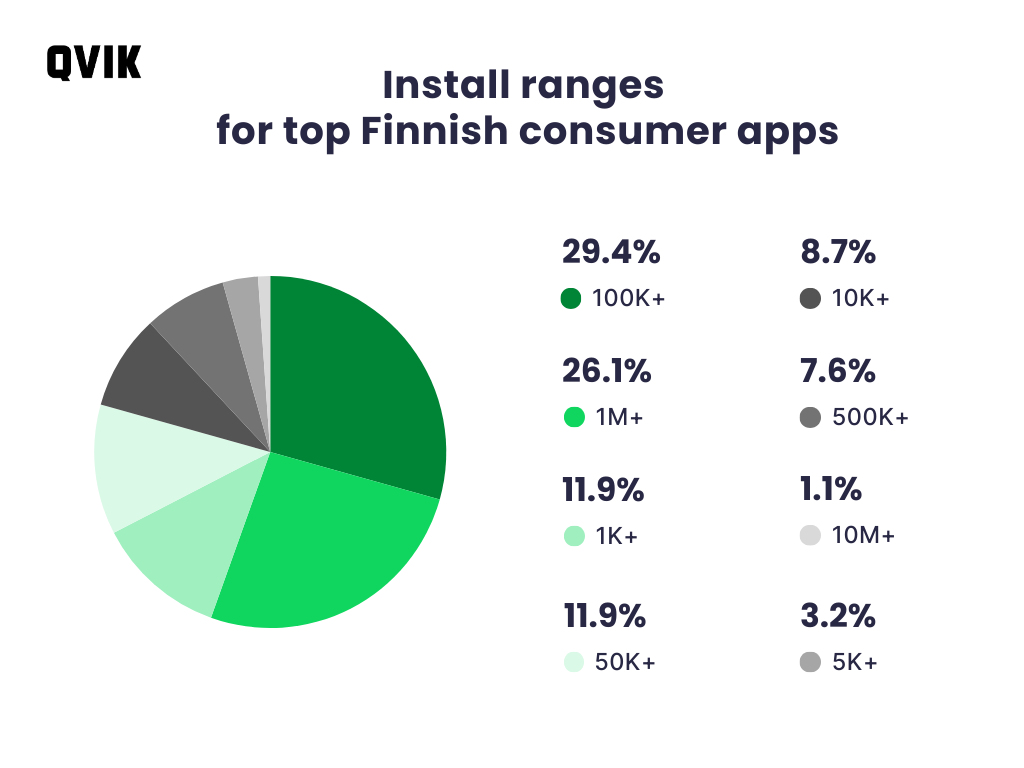

The only app that stands out with over 10M+ downloads in our sample is Wolt. The Finnish food delivery app (acquired by Doordash two years ago) has grown into an international giant and, therefore, plays in its own league.

Apart from Wolt, however, over 55% of top Finnish apps fall within the 1M+ and 100K+ download ranges, dividing relatively evenly between these two.

Categories with apps boasting 1M+ installs include banking, delivery, digital security, ebooks, finance, grocery, news, parking, sports, telecom, transportation, traveling, video, and weather. Unsurprisingly, most of these apps are made for convenient completion of everyday tasks. Examples include reading the news or buying a train ticket. Another common denominator in the 1M+ range is that the services are national.

The 100K+ download range also has national apps for everyday use but for brands with smaller market share.

Did you know, by the way, that with well-executed app store optimization (including some rating hacks), your app could easily grow beyond the market share of your brand?

In comparison, the 1K+ download range includes apps aimed at smaller audiences and non-frequent transactions. These include, for example, local newspaper apps and apps for venues such as amusement parks. App functionality, marketing activities, and other factors that play into download numbers were outside our scope this time.

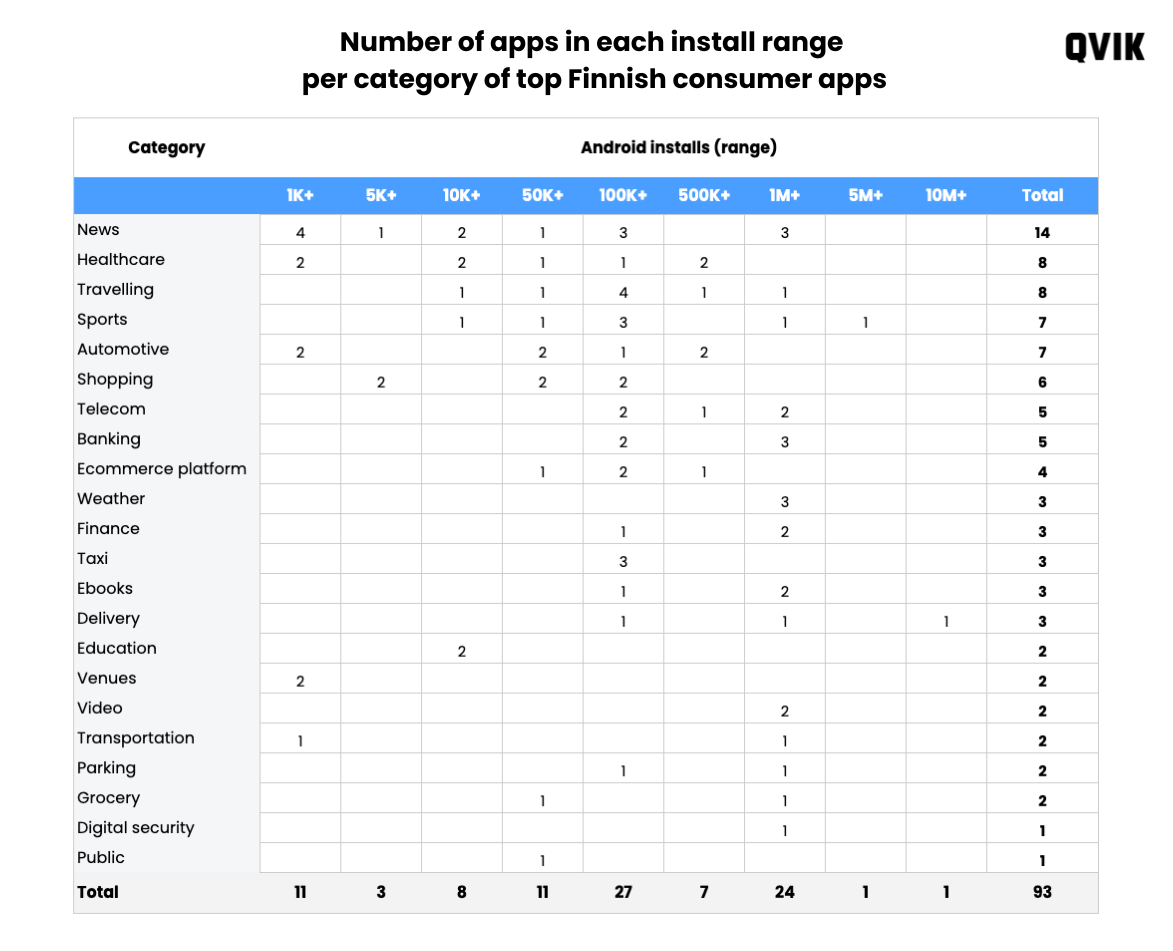

The table below shows the number of apps in each install range for all categories.

Technology stacks used by top Finnish consumer apps

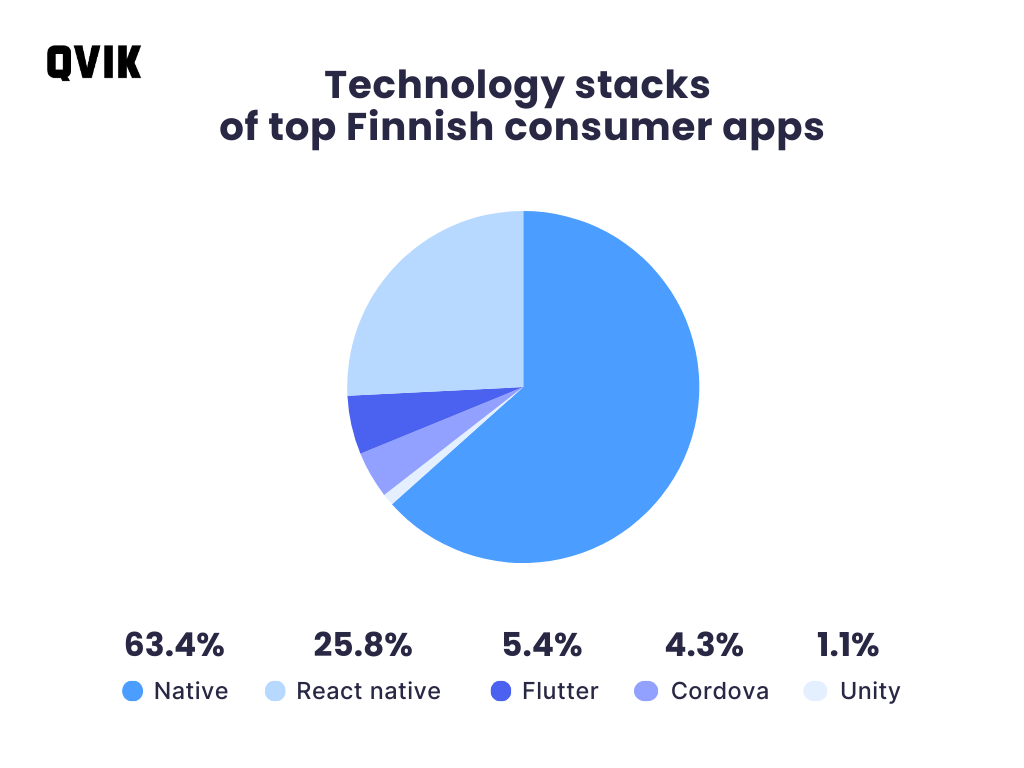

When looking at the technology choices of top Finnish mobile apps, our study revealed a mix of native and cross-platform technologies. Here are our biggest findings.

Native apps are dominant

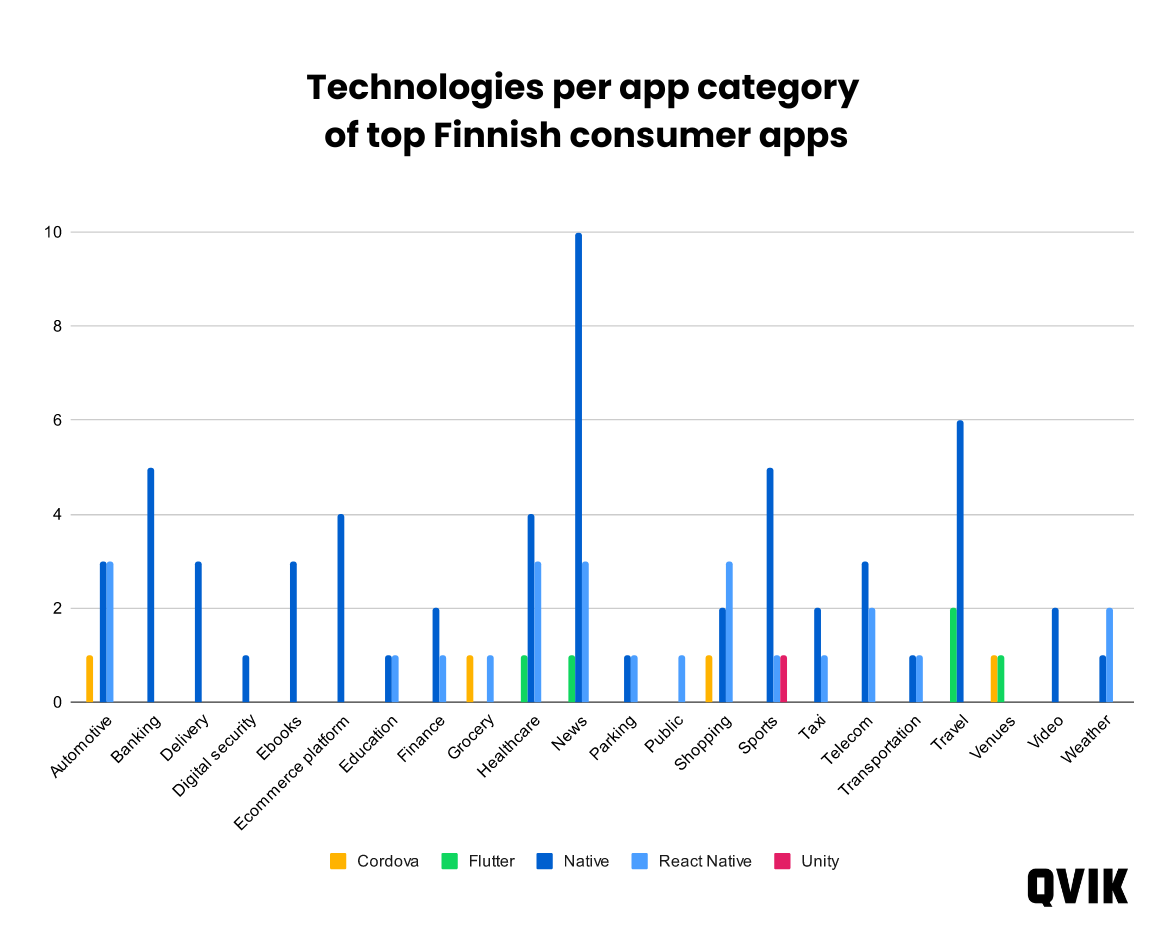

Native apps dominate overall, with a 63,4% share, and are most used across most app categories. Apps with native technology are also exclusively used in specific categories. Examples include banking, delivery, ebooks, and video, where performance and security are critical. The exact number of apps using each technology per category is in Graph 4.

The preference for “true native” highlights brands’ inclination towards the numerous pros of a native application. These include push notifications, flashy animations, accurate positioning and geofencing, biometric authentication, Bluetooth, platform-specific optimizations, and more.

Developing for iOS and Android platforms separately often requires more resources. However, brands seem to prefer the full control over their apps that true native brings along.

Cross-platform holds a steady second place

Despite the dominance of native apps, more than a third of top Finnish apps use cross-platform technologies. Cross-platform enables brands to build their iOS and Android apps on a single development track.

Gains depend on the domain, but overall, cross-platform solutions can significantly reduce repeat work. In Finland, cross-platform technologies are prevalent in automotive, education, news, shopping, transportation, and weather.

Many cross-platform apps enjoy high ratings, and several Finnish apps with more than a million downloads are built with React Native – reflecting its viability in delivering high-quality experiences.

Here’s the distribution between different cross-platform frameworks:

- React Native: Facebook’s framework leads the cross-platform race with a 25.8% overall share of top Finnish apps

- Flutter: Google’s Flutter holds a 5.4% share of top Finnish apps

- Web-based Cross-Platform (Cordova): Accounts for 4% of apps

Interestingly, in a 2023 global survey by Stack Overflow, answered by more than 50,000 professional developers, React Native (9.1%) and Flutter (9.2%) emerged as equally popular technology choices. When comparing these global statistics to the preferences in the Finnish market, it becomes apparent that React Native is significantly favored in Finland.

Despite cross-platform drawbacks – the dependency on the framework and missing support for all native features – its flexibility and cost-effectiveness make it an attractive option. This is especially true in categories that benefit from rapid development cycles and consistent performance across all platforms.

If you’re interested in reading more about the pros and cons of each mobile app technology, please take a look at the in-depth analysis we published in May 2024.

Conclusion

Our study on the technology choices and downloads of top Finnish consumer apps in 2024 highlights the evolving nature of mobile app development in Finland.

Regarding technology, native holds a dominant position with a 63,4% overall share, some categories being exclusively native. Cross-platform technologies hold more than a third of the market, React Native being exceptionally popular in Finland.

Install numbers indicate a successful adoption of mobile apps as an effective consumer channel across industries.

Overall, the findings reveal a developed mobile market with a balanced use of native and cross-platform technologies catering to different business needs and priorities. If you feel like you would like to have some assistance in finding the right approach for you, we are here to help.

Read more: Making your app a commercial and consumer success