Date

23 May 2025

Category

Authentication, Digital identity, PaymentsDigital identity and A2A mobile payments now and in the future

While Helsinki’s Forum shopping center buzzed with KAJ’s live performance on March 26, 2025, another crowd gathered for something a bit more digital just down the street. Signicat and Qvik hosted an insightful event focused on the evolving world of digital identity and account-to-account (A2A) mobile payments – and what’s coming next.

This article was written by:

Sami Nurmi, Senior Advisor & Team Lead, Payments

If you accidentally ended up listening to KAJ instead of us – here are the interesting insights you don’t want to miss!

How is digital identity evolving in Finland and in the EU?

Mikko Pitkänen from Finland’s Digital and population data services agency (DVV) shared how digital identity is evolving in Finland and in the EU.

Currently – although 1,6 million ID cards with citizen certificates have been given out in Finland – less than 1% of identifications happen with these cards. 90% of Finnish online identifications still rely on bank credentials. Mobile certificates make up about 10%.

Only some identifications are done with ID issued by other EU countries.

The EU’s new digital wallet for identification is brewing

By 2026, every EU country must provide at least one official digital identity wallet for all citizens, residents, and businesses.

The EU’s renewed digital identity regulation (eIDAS) sets the rules for digital identity and authentication across the union. Its goal is to make cross-border transactions safe and effortless for EU citizens by letting them use their national digital ID in all EU countries.

Finland is taking part in three of the EU’s digital identity pilot projects. They focus on mobile driver’s licenses, public services access, digital IDs for organizations, and digitally sharing official student records.

Overall, the EU must balance strong security with usability. People need a lasting way to prove who they are, yet an official digital identity has to be simple to use.

DVV will build the Finnish identity wallet

DVV is in charge of building the national digital wallet in Finland, which will most likely be our primary method of authentication in the future. Besides that, DVV has been testing the EU wallet for two years now, helping the union define the technical specifications and regulations for it.

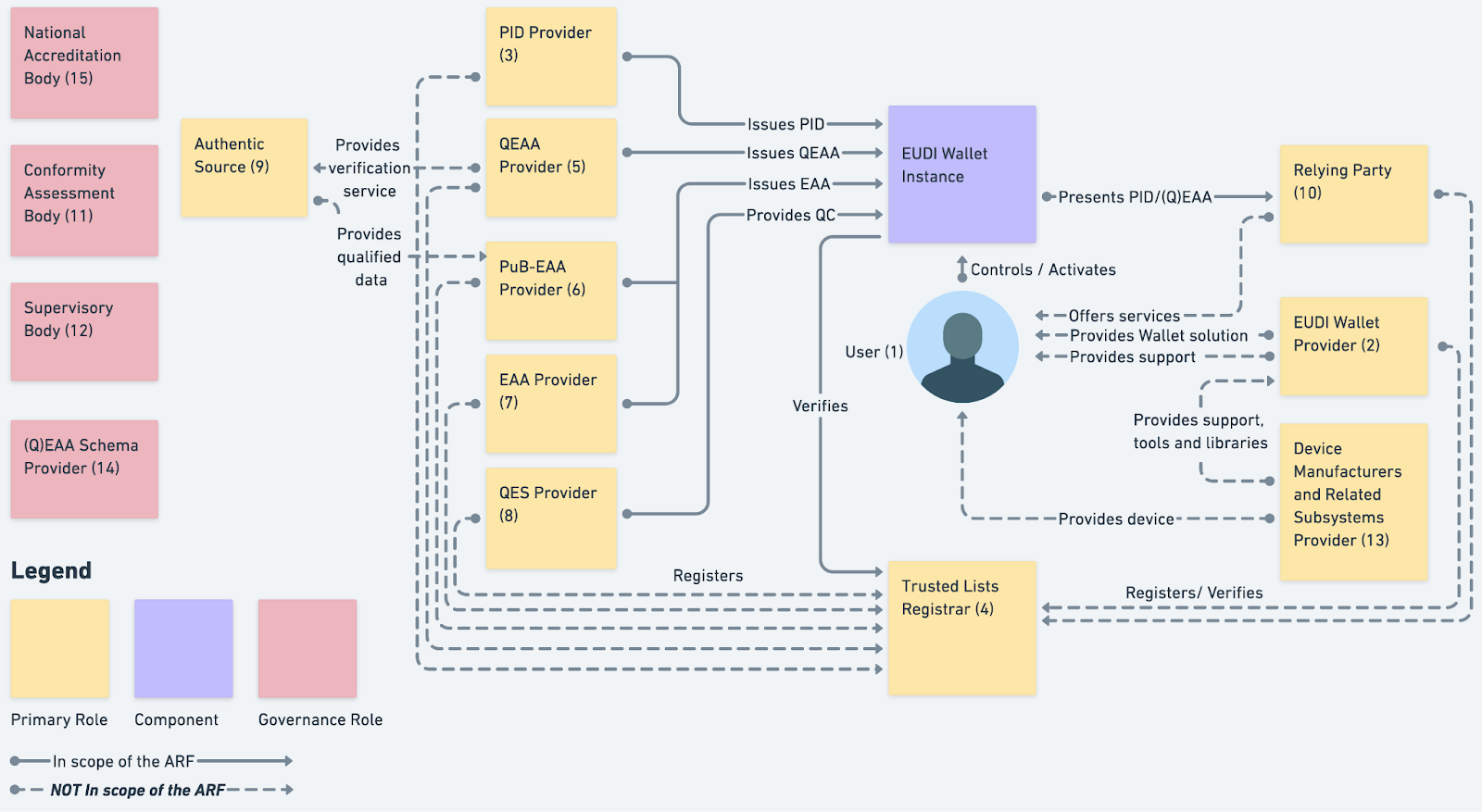

The identity wallets built by EU countries must include an electronic ID, verified user information, and an electronic signature or stamp. The EU has shared a guide called the Architecture Reference Framework (ARF), which includes all the needed services.

In Finland and the Nordic countries, official records are accurate and trusted. Public and private services often use personal ID numbers to access this info. In the future, people should also be able to share this data safely using a digital wallet.

Use cases for the new EU-wide digital identity and wallet

Onboarding – Download the app and verify your identity. Personal details (like your ID number) are pulled from the population register – note: the details don’t include a photo.

Electronic ID – Use your ID number to identify yourself. You can do this with a QR code or directly on your device using a test service.

Adding certificates – Certificates like a mobile driving license can be added to the wallet through the issuer’s online service. At first, DVV will provide this service.

In-person use: – Show your ID and certificates (like a mobile license) using a reader app. For example, the “App Verifier” app for Android can scan and verify your info.

A2A mobile payments – why are they gaining popularity?

Presented by Sami Nurmi, Qvik

A lot is happening currently with account-to-account (A2A) payments in Europe. New systems and projects are popping up all over – including e.g. Wero, EMPSA, EuroPA, Visa A2A, Pikis, and Siirto.

The positive surge is being driven by global trends and new regulation. In addition, low transaction costs and a growing selection of functionalities in A2A systems – like identity and loyalty solutions – are making them more relevant for a wider range of use cases.

Europe needs a more unified market for A2A payments

Many A2A payment systems only work in one country, creating a fragmented market. To fix this, collaboration on standards, guidelines, and best practices has been identified as a crucial factor. To support the effort, the European Payments Council has introduced the Mobile Initiated SEPA (Instant) Interoperability Guidance (MSCT IG)

One way to enable seamless payments across Europe is by offering roaming solutions among participating payment systems, such as the European Mobile Payment Systems Association (EMPSA). Another approach to achieving interoperability is to develop a new pan-European payment solution that leverages the SEPA Instant Credit Transfer scheme, like Wero. In any case, to reach their full potential, A2A payments still need a more unified international market.

The practical issues with A2A payments

In environments like grocery stores, transaction speed is crucial, as delays can disrupt the entire customer experience. While speed is important, the risk of fraud and misuse poses a challenge.

In addition, gaps in rules – for example regarding chargeback processes – leave businesses vulnerable to financial loss. The limited scope of certain use cases can also restrict usability, which requires businesses to use several systems.

To provide a seamless yet safe process for both businesses and consumers, A2A payments still have ways to go.

Why are A2A systems gaining popularity, then?

So what makes A2A systems viable?

A favorable environment in terms of attitudes, digitalization, and regulation supports the adoption of A2A payment methods. One major appeal is the ability to attract customers with fee-free P2P transactions, making solutions known and accessible by a big audience.

Seamless onboarding enhances user adoption, while in-app payment confirmation eliminates the need for external authentication, such as mobile banking approvals. Some solutions are directly integrated into mobile banking, removing the need for a separate app.

Broad support from various banks ensures widespread usability for A2A payments, while NFC technology enables smooth payment acceptance in physical stores. Additionally, diverse functionalities cater to different stakeholders, enhancing the overall ecosystem.

Competitive transaction pricing further strengthens the appeal of these modern payment solutions.

Secure and reusable digital identity for mobile

Presented by Riku Louho, Signicat

Electronic IDs are not new – yet, the EU Digital Identity Wallet will be a big advancement

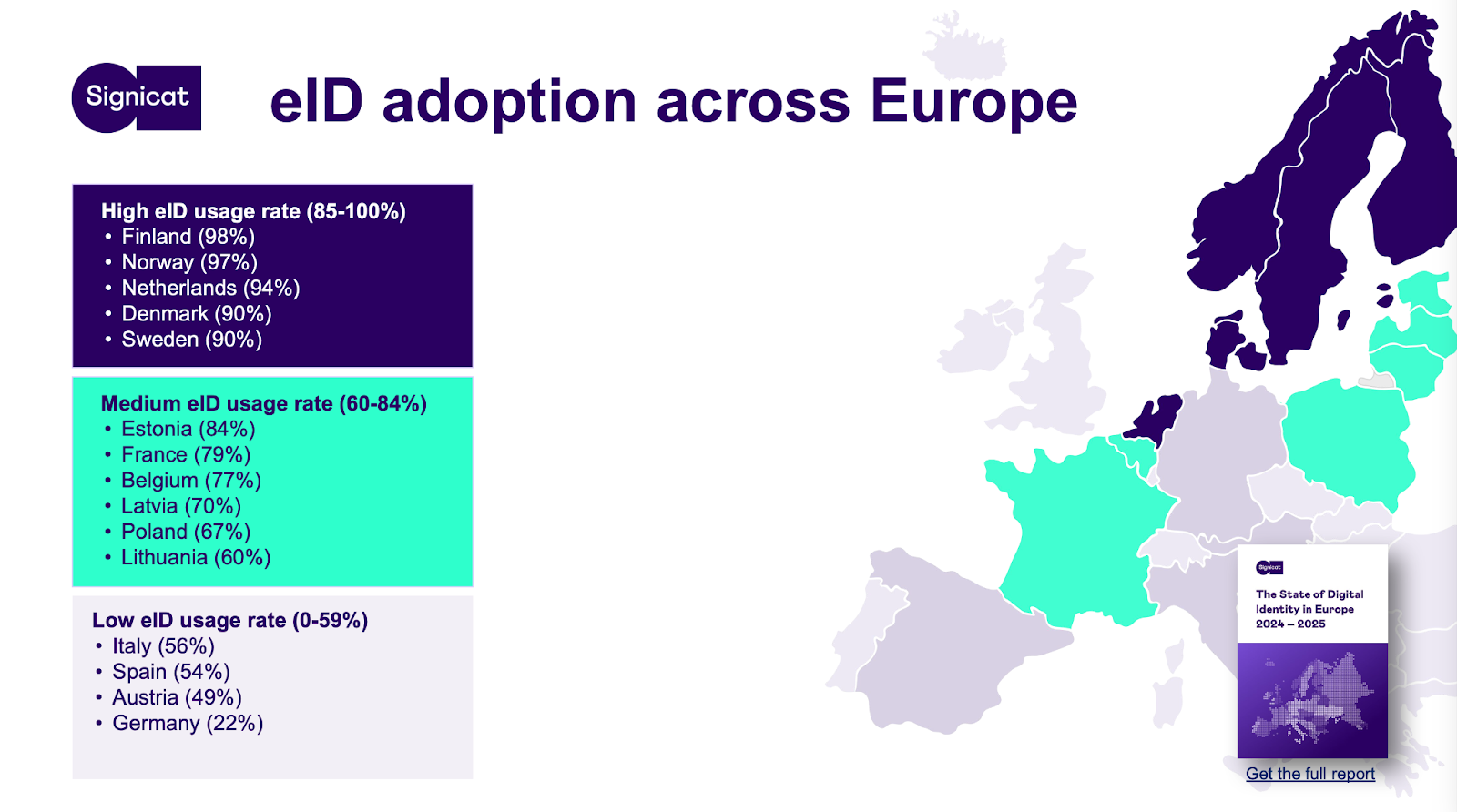

Electronic IDs (eIDs) have been around since the early 2000s for logging in, proving who you are, and online signatures. Their use took off after the 2014 eIDAS regulation, which pushed countries to build better eID systems.

Now, the focus is on the next big thing: the EU Digital Identity Wallet – a safer, easier way to use digital services across Europe.

ID document verification complements eIDs

While eIDs are secure, sometimes we need quicker or more flexible ways to verify identity, especially on mobile. That’s where ID document verification helps. It checks an ID using a photo, video, or NFC scan and makes sure the person is there with a liveness check. It’s fast, secure, and can verify someone in under 45 seconds.

Why does mobile need a special identity approach?

On mobile, users expect smooth, app-like experiences — users prefer FaceID-like user experiences rather than filling out forms or using separate eID apps. While eIDs are secure, they’re not always built for quick, repeat use on a phone.

At the same time, traditional methods like passwords or basic biometrics aren’t secure enough. That’s why digital identity must be both secure and mobile-friendly, while still following regulation.

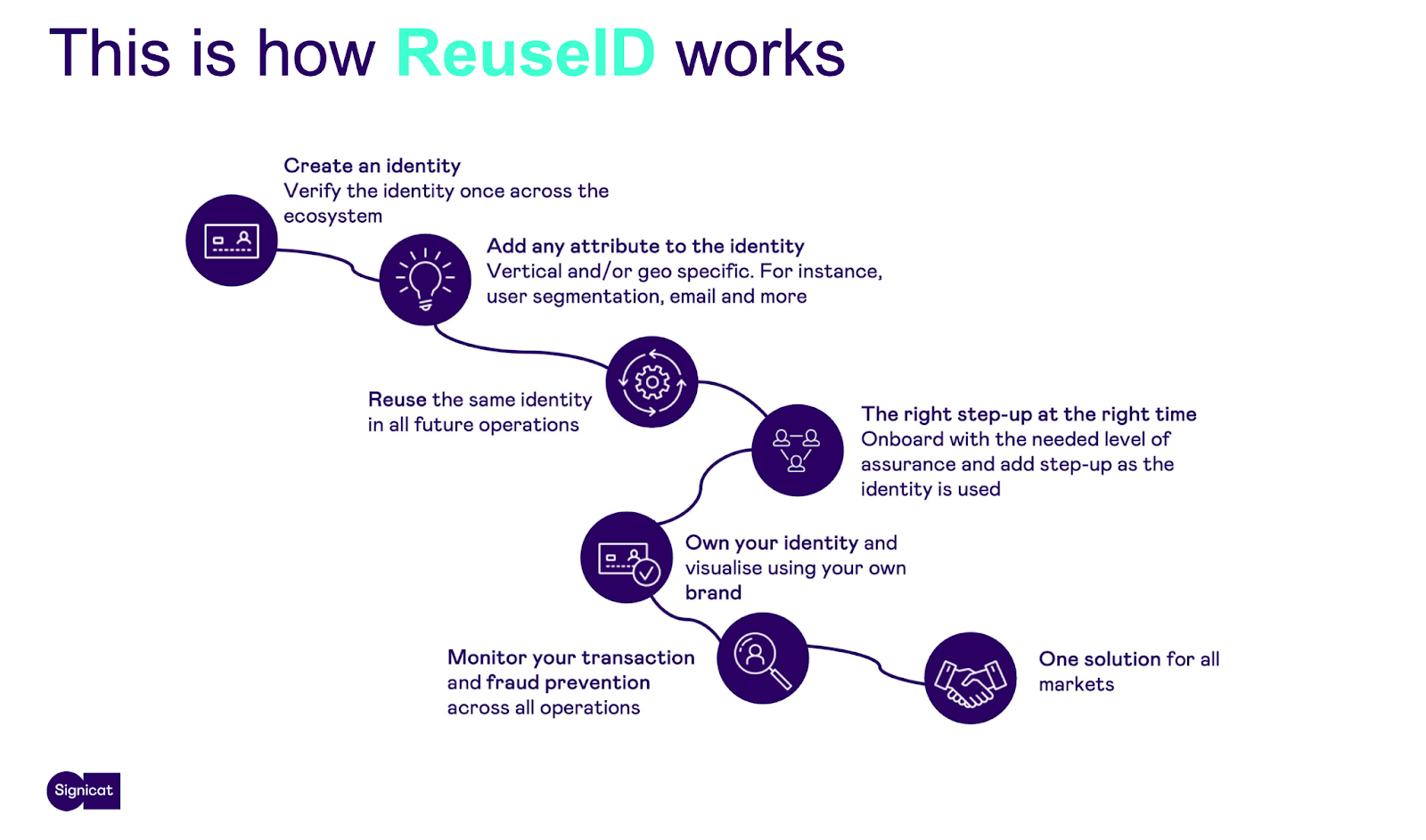

Signicat ReuseID

ReuseID is a banking grade mobile authentication technology enabling users to prove who they are using either an eID or an ID scan when the user is registering for the first time. For recurring use, the users can then confirm things like logins or payments with a fingerprint, face scan, or PIN – all within the app.

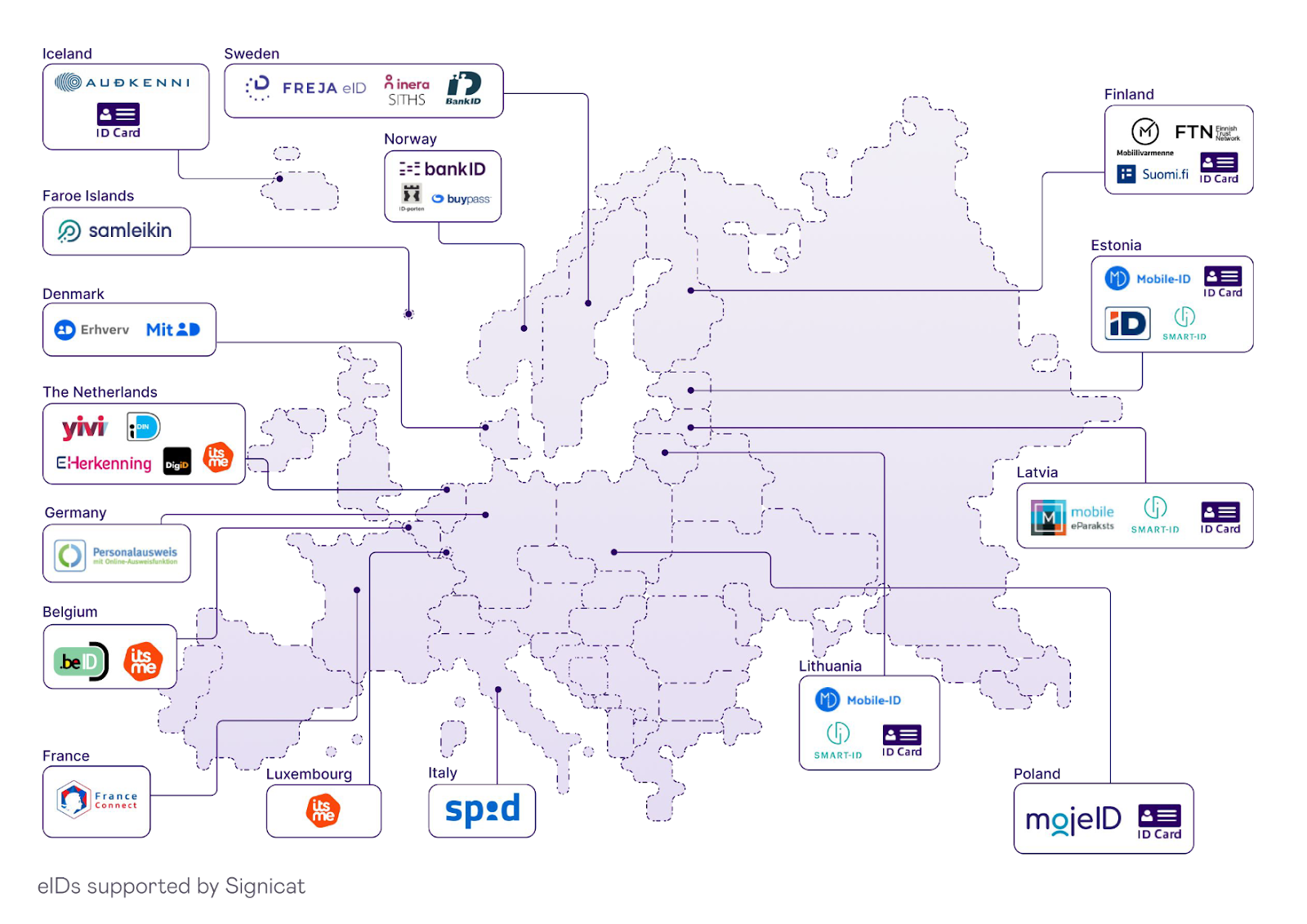

It follows security rules like PSD2 and works with over 35 types of eIDs across Europe and 530+ ID documents in 155+ countries – and it achieves a 97% success rate in recurring logins, which outperforms eIDs alone. It’s a strong solution for everything from app logins and payment approvals to confirming identity in customer service.

ReuseID is especially helpful in banking and finance, where strong security and low fraud risk are important. It also supports secure payments and makes checkout faster for Buy Now, Pay Later services. Outside of finance, it can be used in areas like retail, gaming, logistics, and transport — anywhere a trusted, reusable digital identity is needed.

Summary of the event

Overall the heat and vibes in the event were somewhat as high as in Bara bada bastu. The presentations were packed with insights, and the discussions afterward kept the energy going.

If anything regarding the evolution of digital identities or A2A systems caught your interest, or if you’d like to dive deeper into the themes, we’re just a message away.