Customer

Savings Bank Group

Scope

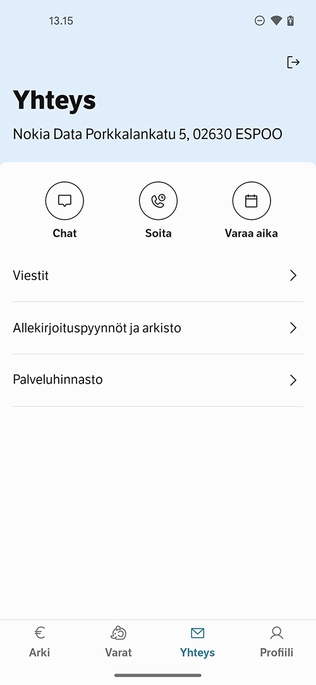

Concept design, UX-design, UI-design, Android development, iOS development, hosting

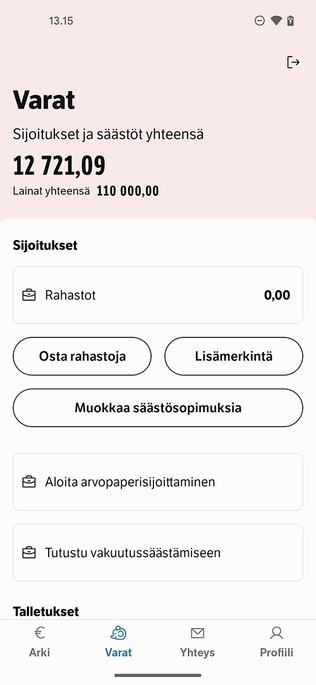

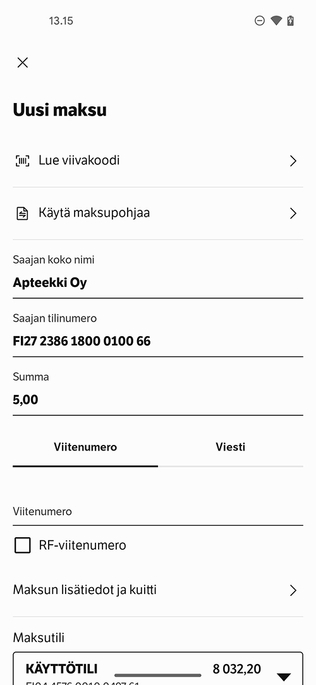

Savings Bank Mobile helps you build a financially flexible everyday life

The mobile app is one of the cornerstones of Savings Bank’s business

For over 200 years, Savings Bank has been helping its customers achieve financial well-being. The goal of offering Finland’s best banking experience continues to drive innovation – including the Savings Bank Mobile app, one of the key pillars of the bank’s business.

Qvik has been Savings Bank Group’s trusted app partner for seven years. The long-term collaboration is built on mutual trust and includes strategic product management, service concept design, user interface and experience design, as well as iOS and Android development.

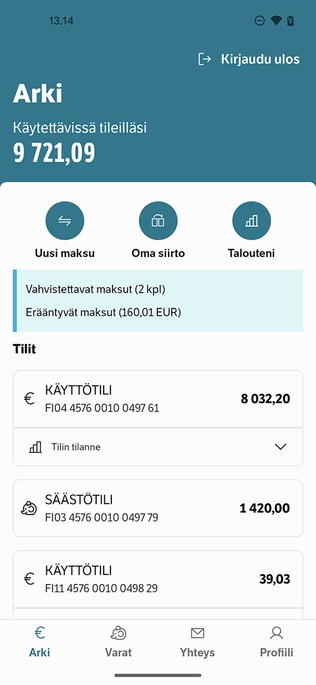

The Savings Bank Mobile app serves customers of fourteen local Savings Banks, providing access to banking services anytime, anywhere – whether in line at the supermarket or on a hiking trail in Lapland. With an average rating of over 4.5 stars, the app has become the primary way to manage their everyday finances for an increasing number of customers.

A smart mobile app is key to sustainable growth

Savings Bank’s partnership with Qvik began in 2018 with a major redesign of its mobile app. From the beginning, the goal was to create an intuitive, forward-looking app that fits naturally into customers’ daily lives.

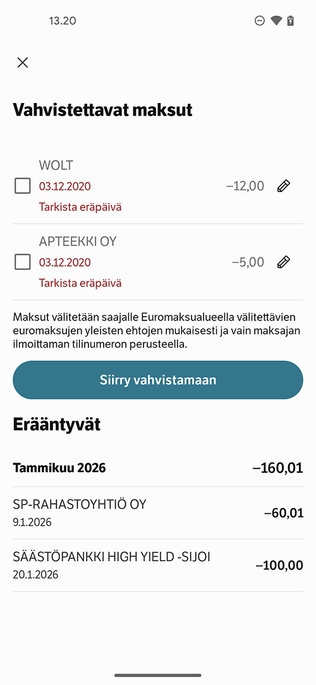

By 2025, the app has undergone another significant evolution. The updated version introduces new financial well-being services, a refreshed brand identity, modern technology, and a cutting-edge design system – all built around a smarter, more customer-centric experience.

“We started building a new mobile bank in 2018, and we chose Qvik as our partner because of their reputation for excellent customer and digital experiences. The collaboration has proven to be both effective and productive – the best mobile bank in Finland speaks for itself.”

Pekka Suomalainen, CIO, Savings BankIn the competitive financial sector, digital services make all the difference

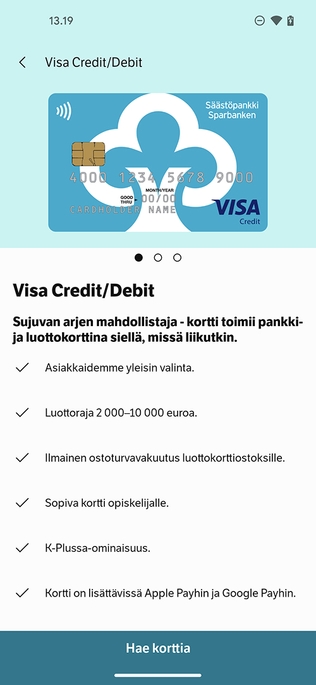

The financial industry is constantly evolving. Consumers have high expectations for mobile services, while regulation continues to shape digital development. Savings Bank is proactively enhancing its mobile app to meet not only today’s needs but also those of tomorrow – even as customer behavior continues to shift.

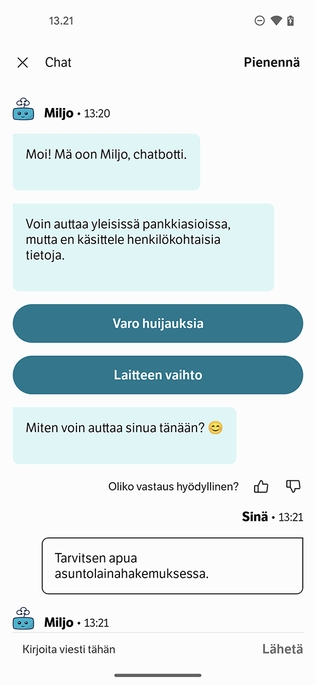

As part of the latest renewal, Savings Bank launched new financial well-being features, designed together with Qvik, to help customers build financial security and more worry-free everyday lives.

“We want Savings Bank customers to truly feel that their financial well-being is valued and cared for.”

Roosa Kotilainen, Product Designer, QvikCustomer-centric design drives success

The development of the Savings Bank app is guided by deep customer insight – gathered through surveys, interviews, and user testing. Accessibility is also a key part of this user-first design approach.

The latest app update introduced a completely renewed design system, making design choices easier and ensuring consistent, flexible use of the brand identity across all Savings Bank channels.

“It’s important for Savings Bank to genuinely meet the needs of all kinds of customers.”

Aija Malmioja, Senior Product Designer and Team Lead, QvikCollaboration that delivers results

Rapid technological change requires seamless teamwork. The latest updates have further strengthened collaboration between Savings Bank’s design and development teams, resulting in a modern app that meets customers’ growing expectations across platforms.

“The most enjoyable part of the renewal was seeing how the team’s different personalities worked together. Everyone brought their own strengths to the table, and it was inspiring to see how well they complemented each other. Although the project was extensive and at times challenging, we succeeded together with humor and great team spirit – and the result is fantastic”. concludes Katja Toivonen, the Mobile App Development Manager at Savings Bank.