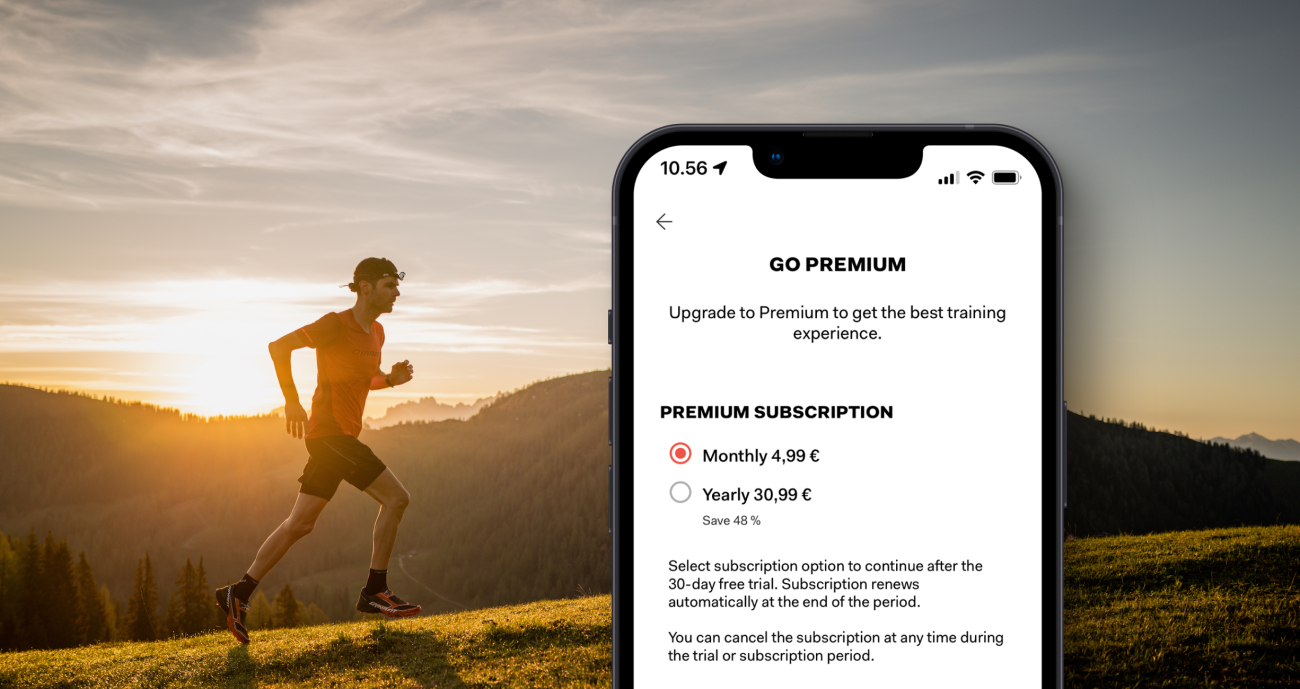

Lessons from Suunto Sports Tracker Premium: How to build the best subscription-based model for your business

Building a successful subscription-based digital product starts with knowing what your customers need, what they are willing to pay for it and what their preferred payment method is.

Subscription-based business models have a lot of potential. We saw this clearly in a Qvik Insights study we conducted last year: 51% of Finns who have paid for an app or made an in-app purchase during the past year prefer to pay for their mobile services as a monthly subscription valid until further notice.

Only one in ten prefers a fixed-term subscription, and only 15% of Finns prefer to pay for mobile services with one-time payments.

So far, subscription-based business models have been most common in entertainment and educational apps. As most Finns are willing to use a subscription-based payment method but only have one to three active subscriptions, other industries too have a great opportunity to leverage the subscription economy.

Suunto Sports Tracker Premium got a 68% increase in premium users in a few months, and 70% of the new users continued after the free trial

One great example of a well-executed subscription-based application is our client Suunto’s Sports Tracker Premium. Sports Tracker was one of the first mobile sports trackers and has hundreds of thousands of active users each month, with over 700,000 users just in Finland.

Suunto acquired Sports Tracker in 2015. To change the app from a money sink to a viable business, they started building a subscription-based premium model around it in November last year.

The design work for Sports Tracker Premium is done by Qvik’s Minna Nurminen and Oona Lindqvist. In the beginning, the team consisted of Suunto’s product owner Antti Sorvari, Nurminen and Lindqvist, Qvik developers Kate Khudzhamkulova and Joel Pöllänen, and one developer from Vincit.

The work started with surveys and benchmarking and ended with a ROI of over €110,000/month

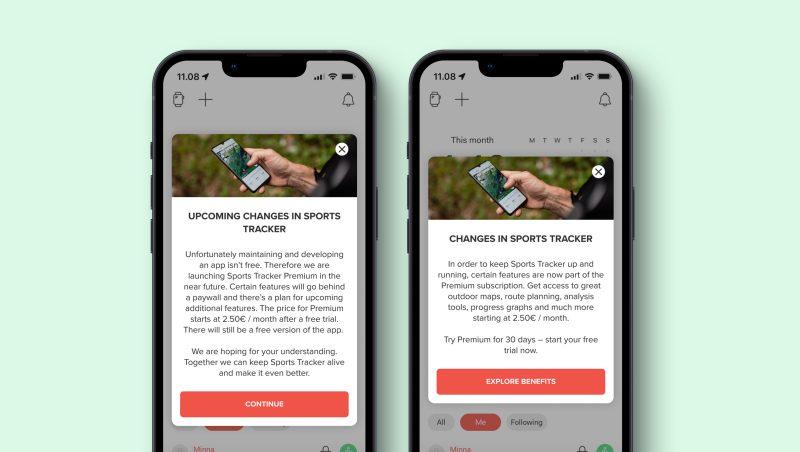

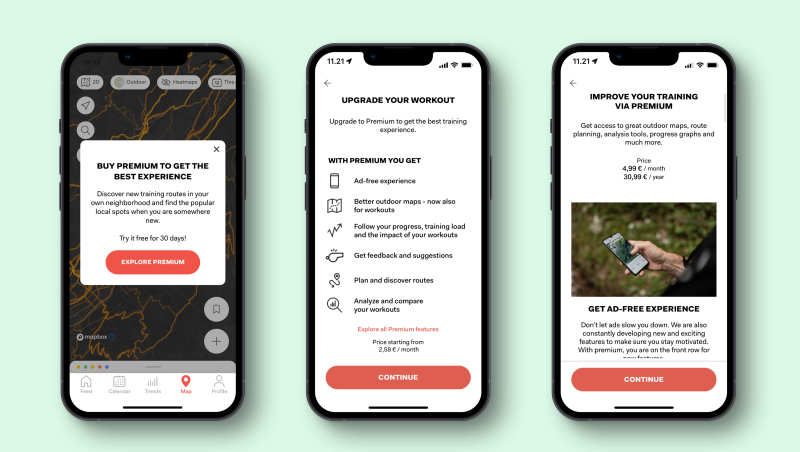

As Suunto wanted to keep Sports Tracker partially free, the team needed to strike a perfect balance between keeping the app viable and usable for everyone and still giving enough value for premium users so they would pay for it.

The first step was to find out how interested Sports Tracker users would be in certain content and features that the team already knew were popular and possible to deliver.

“Then we asked if the users would be willing to pay for that content, and if so, how much. In addition, we asked background questions to get an understanding of what types of users would be willing to pay”, says Qvik’s product designer Minna Nurminen, who had a crucial role in the concept, validation and design work of Sports Tracker Premium.

Benchmarking and user surveys confirmed the existence of a market and an audience for Sports Tracker Premium.

“Our work in defining user personas and value propositions helped us stay focused on the user’s needs. Together with the survey results and user data, this helped us decide what features to include in the premium subscription.”

Minna Nurminen, Product Designer from Qvik

As stated in the subheader, this story has a happy ending: users see the value of Sports Tracker Premium, are willing to subscribe, and the premium feature produced €110,000 in revenue to Suunto already in May 2023. Since then, the amount of subscribers has increased steadily and, naturally, so has the revenue.

Get ready to improve acceptance rates with network tokenisation

When we studied the reasons why Finns cancel their subscriptions, we found that almost a fifth (18%) stopped using a service simply because the service period ended and they did not renew the subscription – so they didn’t even actively decide to cancel.

One way to make it easier for the user to continue a subscription is to use network tokenisation in the payment flow. Google Pay and Apple Pay already rely on network tokenisation, and soon, it will be available for all card payments.

“The health and prosperity of a merchant’s business are closely tied to the authorisation rates of payment cards. When the card authorisation rate is higher, there is an increased probability of repeat customer transactions, leading to higher business revenue”

Sami Nurmi, Payment Specialist from Qvik

With the growing adoption of subscription-based business models, the significance of a secure and seamless payment solution for handling recurring transactions cannot be emphasised enough. Network tokenisation plays a vital role in this, as it substitutes sensitive card information with unique tokens.

These token values safeguard cardholder details and maintain the capability to execute transactions even if the physical card is lost, blocked, or expired. Essentially, this incorporates a card-updater functionality and protects recurring payments.

This article is written based on Qvik’s and Paytrail’s event The subscription revolution: Exploring the future of digital business. Paytrail offers a mobile payment SDK that supports recurring payments through payment card tokenisation. The technical implementation of Paytrail’s mobile payment SDK is done by Qvik’s developers.

Download Qvik Insights report of the most attractive business models for mobile apps and digital services.

Building mobile business on facts

We studied how the Finns want to pay in applications, how willing they are to pay for applications, and what expectations they have for customer service and signing in to applications.

If you wish to learn more about how network tokenisation would benefit your business, feel free to contact our advisory team’s Mikko Vahter or Sami Nurmi.