Säästöpankki brought its mobile services up to date

A quality app is like a business card for a bank.

The importance of mobile banking apps is becoming pronounced, as more and more customers want to take care of all bank transactions with their mobile devices. Mobile logins and transactions are eclipsing traditional online banks by a large margin.

“Our old application simply wasn’t living up to the expectations of our customers any more. We wanted to bring the application’s design up to today’s standards, improve the user experience and make the application scalable,” says Mika Käyhkö from Säästöpankki.

“This meant that we had to rethink the functionalities from the ground up, and so the update has made a number of new functionalities available to our customers.”

“We wanted to partner with somebody who had the competence for elegant design with a great customer experience. The customer experience is supremely important for us, and achieving a brilliant customer experience requires more than just technical competence. Qvik had the right strengths and technological expertise, which tipped the scale in their favor in our choice of partner.”

Mika Käyhkö

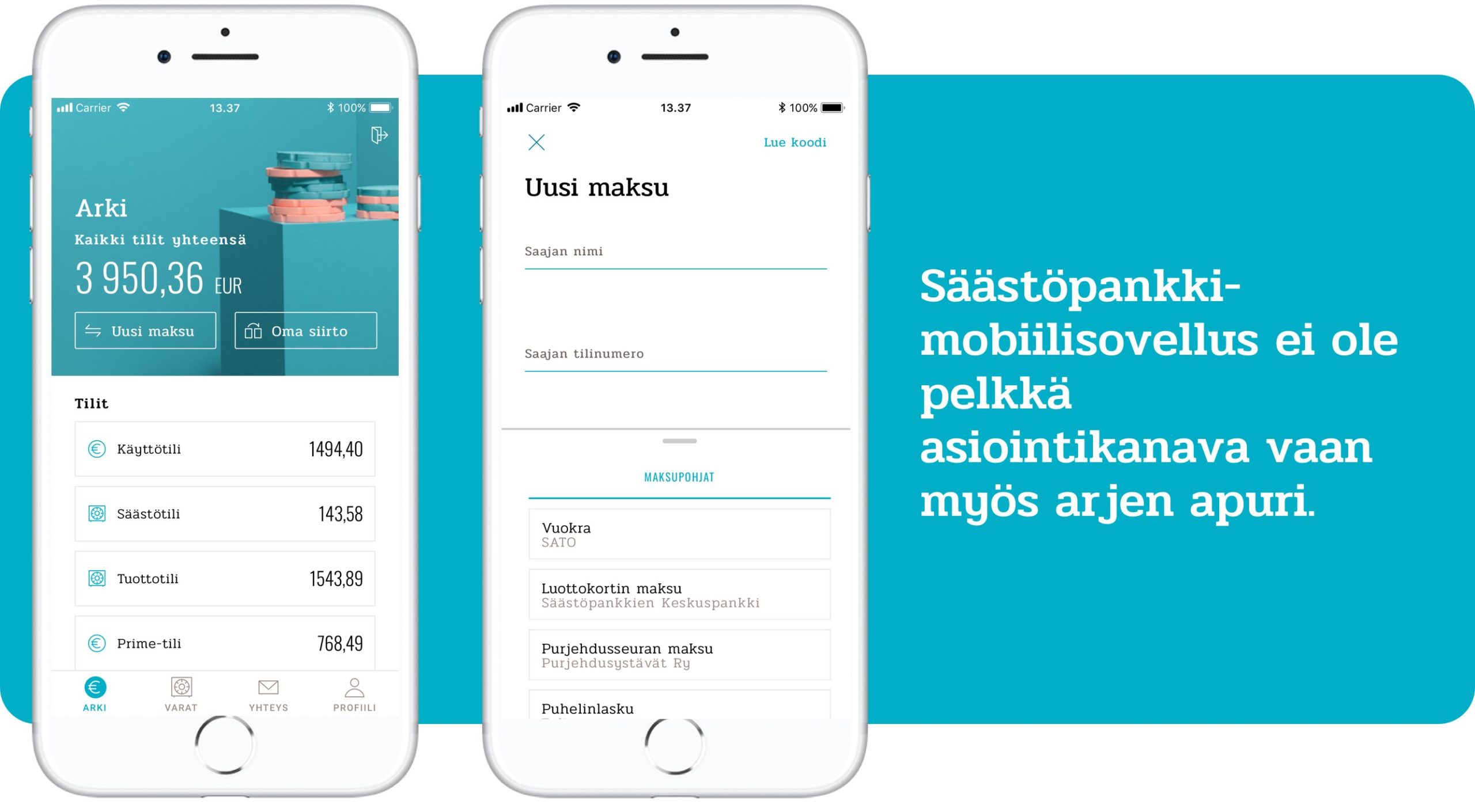

The Säästöpankki mobile app is more than just a channel for using banking services – it’s also an everyday personal assistant.

Digital services are hugely important to customers and can be decisive in their choice of bank. The new app gives Säästöpankki a better position on the market with regard to the competition.

“Customers have to be able to take care of all of their daily banking needs with the mobile app. In addition to its role as a service channel, a modern mobile banking app is a little like the piggy banks of old”, Käyhkö says.

“It is the bank’s business card. Just as we used to compare piggy banks, the mobile app is today’s benchmark. We want our customers to feel proud of the services we provide.”

Regulations impose restrictions, but also create opportunities

The new payment services directive (PSD2) will intensify the competition in the fields of digital banking and financial services. The directive will permit customers to use one bank’s application to access their accounts in other banks as well. It would be impossible to stay in the race without a competitive mobile app.

In addition to taking care of everyday financial matters, the app provides an overview of the customer’s assets and loans and enables trading in stocks and fund units.

“The most important thing is to serve the needs of our customers. We want our customers to carry Säästöpankki’s application in their pockets. And who knows, in the future, maybe the customers of other banks will want to use it as well.”

Biometric authentication was added to the mobile app’s login options, but users still need an authentication application to confirm their payments.

“We know the banking business, but Qvik’s fresh perspective and knowledge of other industries was valuable. It takes class and skill to create a smooth user experience that combines the financial sector’s regulatory requirements with a clear and simple customer experience. This was precisely what we were able to achieve together with Qvik.”

Mika Käyhkö

Development is guided by analytics and customer feedback

“Qvik has emphasized the significance of analytics in development, and we know how to listen to our customers. That is a combination that keeps application development on the right path.”

Mika Käyhkö

Analytics play an essential role in both business and application development. Säästöpankki has always done well in customer satisfaction surveys and wants the mobile app to live up to this track record.

Customer feedback and usability have been taken into account in all project stages from the drawing board up. The functionality of the application has been tested with street polls and usability tests both before and during development.

For more information

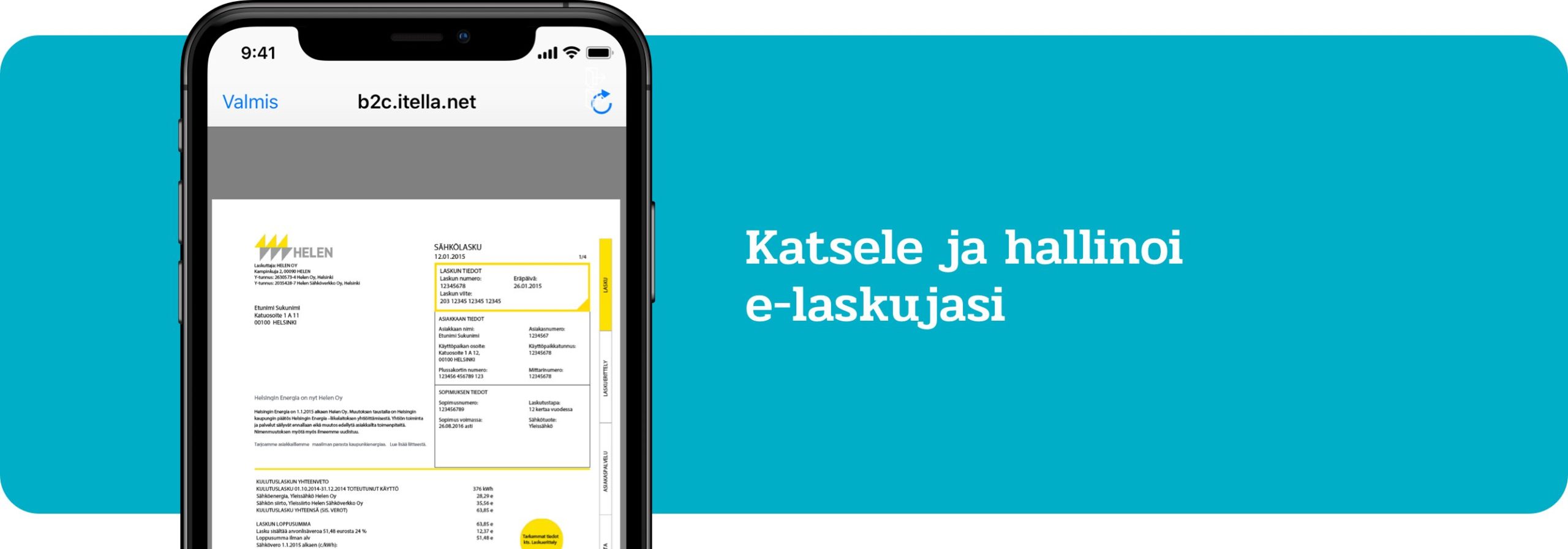

Posti Payment Gateway

Qvik has designed and developed the Posti’s cloud-native, multichannel Payment Gateway solution together with Posti.

VR Ticket Vending Machine

Qvik focused on data-driven design and user testing.

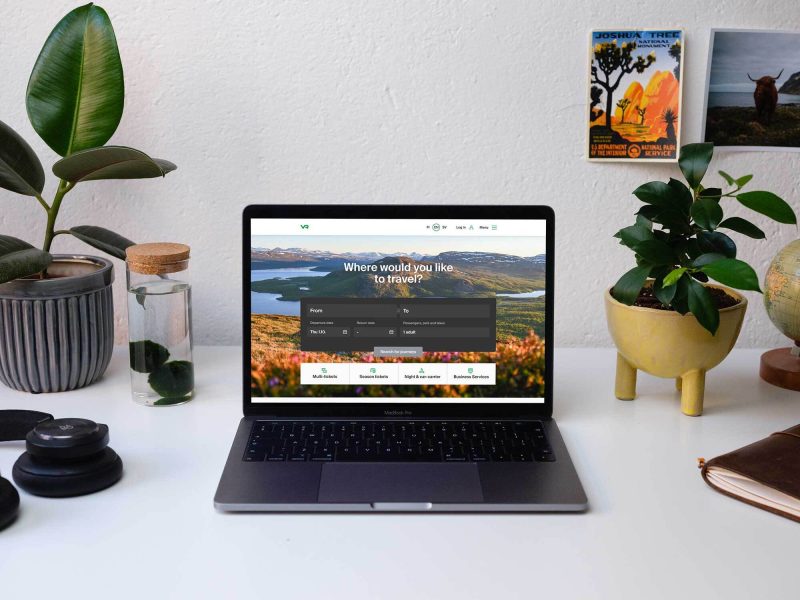

VR.fi

The new vr.fi website is the outcome of a well-functioning multivendor team.