Posti Payment Gateway

Providing easy payment solutions is one of the cornerstones of Posti’s digital business. The new Payment Gateway makes this, and much more, possible.

Finland’s postal service Posti aims to be a pioneer in the Finnish e-commerce sector. To succeed, they need an effortless payment and login process and the ability to develop their operations on the basis of analytics.

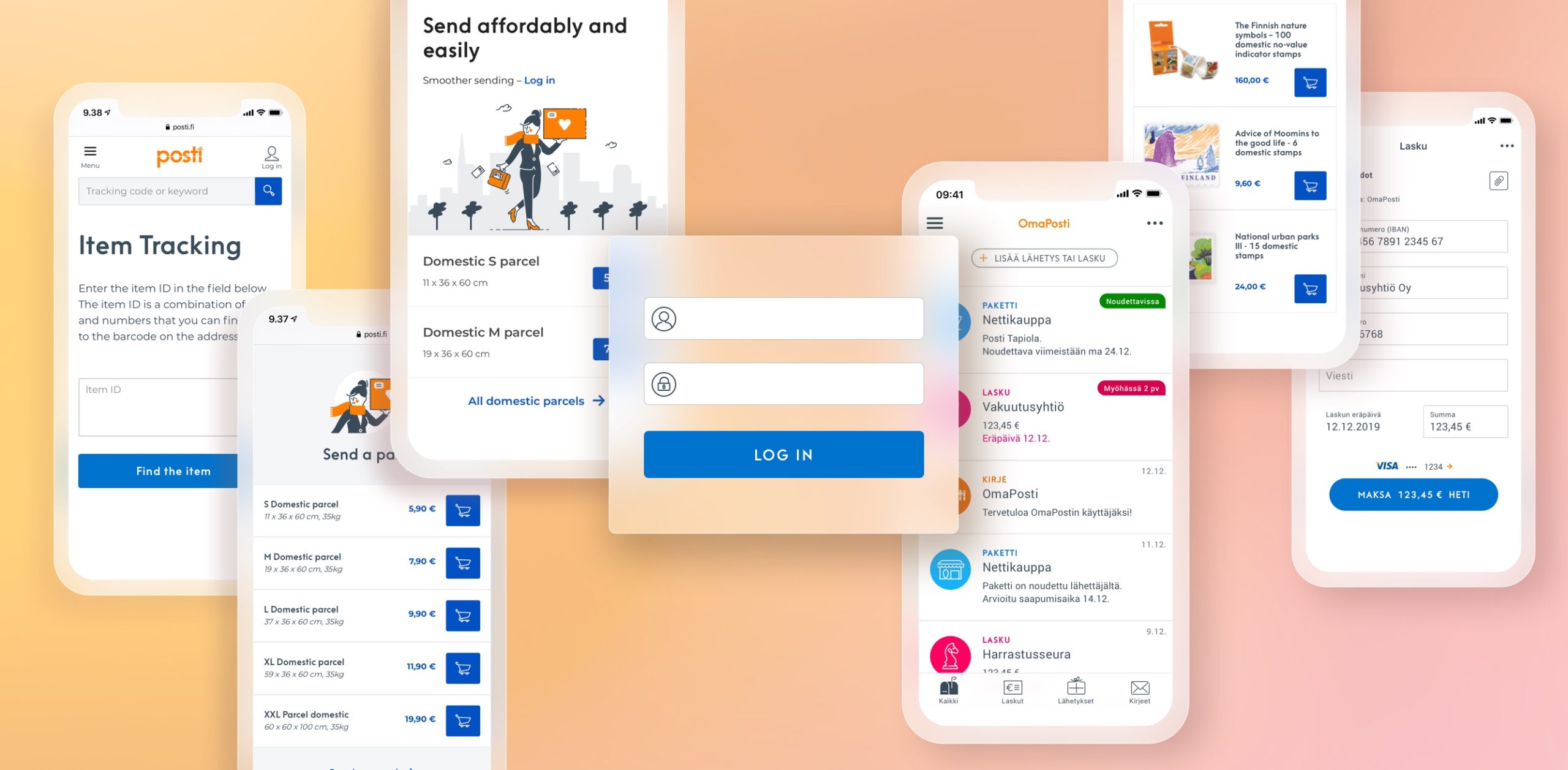

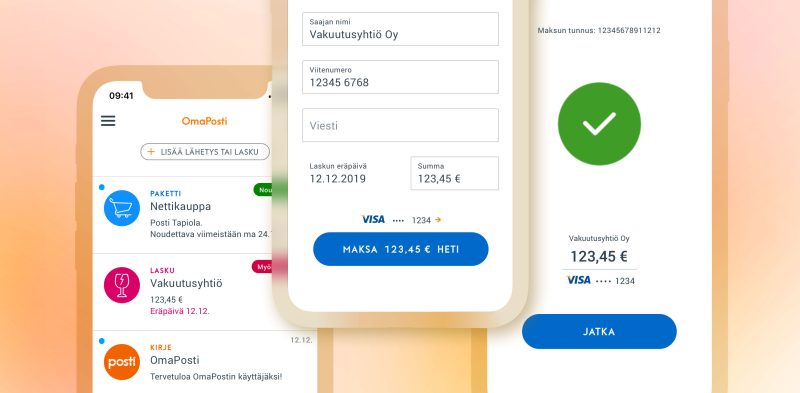

Posti operates 13 distinct ordering channels and payment system integrations through which customers can buy everything from services to stamp collections and packaging materials online. Before the Payment Gateway (PGW) update, the system was extremely complex and difficult to manage. The user experience was fragmented, as customers were not able to use stored credit card details across payment channels, for example.

“The update unifies the look and feel of Posti’s digital services and enables a personalized service”, says Raine Westerholm of Posti.

“When all payment-related functionalities are harmonized, the customer experience will be the same for everyone using our services. The implementation is technically flexible and makes the introduction of new payment methods easier, so the services will also meet the changing needs of our customers better.”

Raine Westerholm

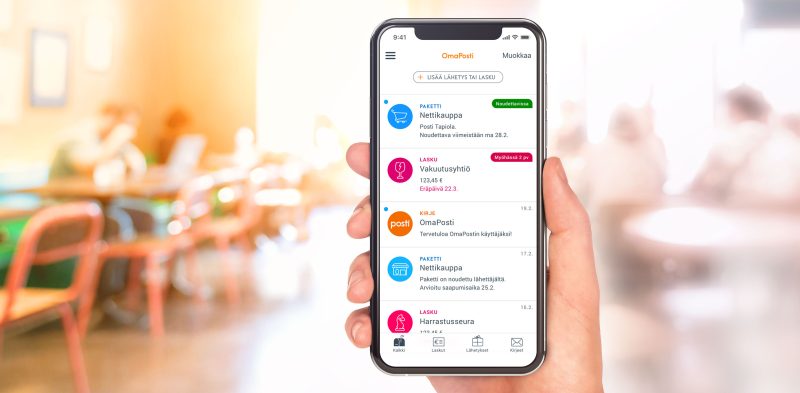

Posti is renewing and developing its digital services based on extensive customer surveys. The goal is to create services that will make the daily lives of customers genuinely easier. This was also the philosophy behind the OmaPosti application and its invoice payment service running on Payment Gateway.

Qvik designs and develops the OmaPosti application and Posti’s cloud-native, multichannel Payment Gateway solution together with Posti.

All of Posti’s digital services will be based on the PGW solution, which has a major role in three crucial service aspects: login, onboarding and payments.

PGW enables business analytics

No matter how many payment methods you are offering, Payment Gateway compiles the data into a single, standardized interface. In the new solution, all ordering channels are connected to Posti’s ERP system through a single interface. That makes financial management easier and provides robust analytics for Posti’s digital business.

“Posti’s operations will be better supported by data when all payment transactions can be found in one place.”

The first step in developing a new digital service is charting the customers’ needs. But that’s just the beginning: Only real user analytics will show whether the product is working as intended and what areas still have room for improvement. To this end, PGW collects and analyzes payment behavior data in line with today’s standards.

Learning to live with legacy systems

Posti is almost four centuries old, so the organisation has been through every phase of the digital revolution. Technological advances inevitably make some solutions obsolete, and such legacy systems present challenges in the digital environment.

“As a customer you can’t see the old technology, but there’s always something that needs work under the hood.”

Posti’s Payment Gateway is a cloud-native solution built on the Google Cloud Platform, with VPN (virtual private network) connections to Posti’s data center and the AWS used by OmaPosti.

“PGW simplified the jumble of interfaces accumulated onto our ERP systems. We were able to uncouple the individual interfaces of ordering channels and payment service providers from our ERP system and link them to PGW with modern APIs.”

From now on, adding new ordering channels or payment methods will be a whole lot simpler, and Posti will be able to develop its systems on the terms of modern technology, instead of legacy systems.

Requesting quotations from PSPs requires expertise

Posti invited tenders from payment service providers (PSP) for the implementation of the PGW. It is a complicated process, since comparing tenders from the perspectives of technology, the customer experience and pricing is a challenging endeavor that requires a high level of expertise.

“Some will give you a lump sum, others a ladder; one pushes the transaction fee down and commissions up, while another does the exact opposite. The services’ backend technologies vary widely, which will affect service integration and, ultimately, the customer experience. Comparing such tenders is extremely tricky.”

The key was to find a PSP that would meet Posti’s payment needs from the consumer’s point of view, today and in the future. These needs were defined in an inhouse workshop held by Qvik. We also helped Posti decipher the technical capabilities of the PSP candidates.

Qvik will continue working with Posti in the development and maintenance of PGW, as well as the design and development of OmaPosti.

“It was important to find a straight-forward service provider with the right feel and mobile software development kit for OmaPosti. Qvik’s technical expertise and deep market insight helped us choose the way to go.”

Raine Westerholm

For more information

OmaPosti

Qvik redesigned OmaPosti app’s user interface and did further development on the application, especially on native mobile platforms.

Säästöpankki

The Säästöpankki mobile app is more than just a channel for using banking services – it’s also an everyday personal assistant.

Terveystalo

The new Terveystalo.com is clean, simple and smooth on any device.